Unlocking Profitability: 5 Key Insights from a Powerful Cash Flow Statement

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unlocking Profitability: 5 Key Insights from a Powerful Cash Flow Statement. Let’s weave interesting information and offer fresh perspectives to the readers.

Unlocking Profitability: 5 Key Insights from a Powerful Cash Flow Statement

The lifeblood of any business, cash flow is the fuel that powers operations, drives growth, and ultimately determines success. While profits paint a picture of financial health, it’s the cash flow statement that reveals the true story – a story of liquidity, solvency, and the ability to meet financial obligations. Understanding this crucial document is not just important, it’s essential.

This article delves into the power of the cash flow statement, uncovering 5 key insights that can help businesses unlock profitability, optimize operations, and navigate the unpredictable waters of the business world.

Understanding the Basics: What is a Cash Flow Statement?

Imagine a business as a river, with revenue flowing in and expenses flowing out. The cash flow statement is like a map of this river, showing where the water comes from, where it goes, and how much is left at the end of the journey. It provides a snapshot of the company’s cash inflows and outflows over a specific period, typically a month, quarter, or year.

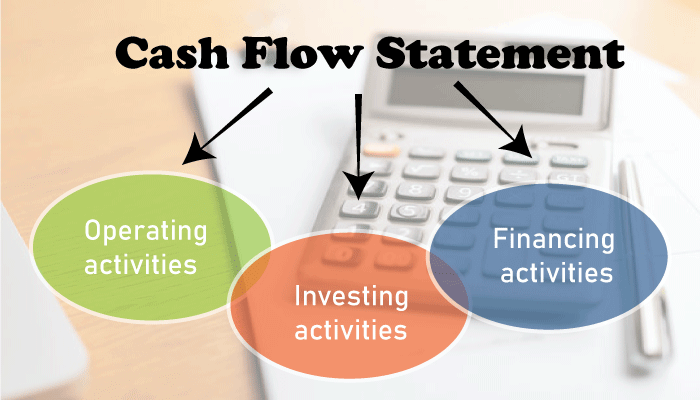

The cash flow statement is divided into three primary sections:

- Operating Activities: This section focuses on the cash generated or consumed by the core business operations. It includes activities like selling goods or services, paying salaries, and paying for utilities.

- Investing Activities: This section captures the cash flow associated with investments, such as purchasing or selling property, equipment, or securities.

- Financing Activities: This section details cash flow related to financing activities, such as taking out loans, repaying debt, issuing stock, or paying dividends.

The Power of the Statement: 5 Key Insights

While the cash flow statement may seem like a complex document, it holds valuable insights that can guide strategic decision-making. Here are five key takeaways that every business owner and financial manager should understand:

1. Unveiling the True Picture of Profitability:

While profits are a crucial indicator of financial health, they don’t tell the whole story. A company can be profitable on paper but still struggle with cash flow. The cash flow statement reveals the actual cash generated by the business, offering a more accurate picture of its financial position.

For example, a company might report high profits but have significant amounts tied up in accounts receivable or inventory. This could indicate a cash flow problem, even with strong profitability.

2. Identifying Cash Flow Bottlenecks:

The cash flow statement helps identify areas where cash is being tied up or lost. By analyzing the different sections, businesses can pinpoint bottlenecks that are hindering cash flow and hindering growth.

For instance, a significant outflow in the operating activities section might indicate inefficiencies in the supply chain, leading to high inventory costs. Similarly, a large outflow in the investing activities section might reveal overinvestment in non-performing assets.

3. Assessing Liquidity and Solvency:

The cash flow statement is a critical tool for assessing a company’s liquidity and solvency. Liquidity refers to the company’s ability to meet short-term financial obligations, while solvency refers to its ability to meet long-term obligations.

A strong cash flow statement indicates a company with sufficient cash on hand to meet its financial obligations and navigate unexpected challenges. Conversely, a weak cash flow statement could signal potential liquidity and solvency issues.

4. Forecasting Future Cash Flows:

The cash flow statement provides a foundation for forecasting future cash flows. By analyzing past trends and current business conditions, companies can estimate future cash inflows and outflows, allowing them to make informed financial planning decisions.

Accurate cash flow forecasting is essential for:

- Budgeting and Financial Planning: Predicting future cash flows allows companies to allocate resources effectively, manage expenses, and plan for future investments.

- Debt Management: Forecasting cash flow helps companies determine their ability to repay debt obligations and make informed decisions about borrowing.

- Investment Decisions: Accurate cash flow forecasts are crucial for evaluating potential investments and ensuring that the company has sufficient funds for growth initiatives.

5. Unlocking Growth Opportunities:

A strong cash flow statement is not just about managing existing operations; it’s also a key to unlocking growth opportunities. By generating sufficient cash flow, companies can:

- Invest in New Technologies: Cash flow allows businesses to invest in cutting-edge technologies, improve efficiency, and gain a competitive edge.

- Expand into New Markets: Strong cash flow provides the financial resources needed to expand into new markets, reach new customers, and increase market share.

- Acquire Competitors: Cash flow can be used to acquire competitors, consolidating market share and strengthening the company’s position.

Beyond the Numbers: Actionable Strategies for Improving Cash Flow

Understanding the cash flow statement is only the first step. The real power lies in using this information to make strategic decisions that improve cash flow and drive profitability. Here are some actionable strategies:

1. Accelerate Receivables: Shortening the time it takes to collect receivables is crucial for improving cash flow. Companies can implement strategies like:

- Offering Early Payment Discounts: Incentivize customers to pay early by offering discounts for prompt payment.

- Improving Invoice Processing: Streamline invoice processing and ensure timely delivery of invoices to customers.

- Implementing Automated Payment Systems: Utilize online payment platforms to simplify payment collection and reduce processing time.

2. Optimize Inventory Management: Excessive inventory can tie up significant cash flow. Strategies for optimizing inventory management include:

- Implementing Just-in-Time Inventory Systems: Reduce inventory levels by ordering materials only when needed, minimizing storage costs and reducing the risk of obsolescence.

- Improving Demand Forecasting: Accurate demand forecasting allows companies to order the right amount of inventory, reducing the risk of overstocking or stockouts.

- Negotiating Longer Payment Terms with Suppliers: Secure longer payment terms with suppliers to free up cash flow and improve liquidity.

3. Control Expenses: Careful expense management is essential for maintaining a healthy cash flow. Strategies for controlling expenses include:

- Negotiating Lower Prices with Suppliers: Leverage purchasing power to negotiate lower prices for materials and services.

- Optimizing Operations: Identify and eliminate inefficiencies in operations, reducing waste and unnecessary expenses.

- Implementing Cost-Saving Measures: Explore cost-saving measures such as energy efficiency upgrades, reducing travel expenses, and negotiating lower insurance premiums.

4. Leverage Technology: Technology can be a powerful tool for improving cash flow. Consider implementing solutions like:

- Automated Accounts Payable Systems: Automate accounts payable processes to streamline payments and improve efficiency.

- Cloud-Based Accounting Software: Utilize cloud-based accounting software to gain real-time visibility into cash flow, track expenses, and generate reports.

- Cash Flow Management Software: Invest in dedicated cash flow management software to automate forecasting, analyze trends, and optimize cash flow.

5. Seek Expert Advice: Don’t hesitate to seek expert advice from financial professionals. A qualified accountant or financial advisor can provide valuable insights, help develop a comprehensive cash flow management strategy, and ensure that the company is making informed financial decisions.

Conclusion: A Powerful Tool for Success

The cash flow statement is not just a financial document; it’s a powerful tool that can unlock profitability, drive growth, and ensure the long-term success of any business. By understanding the key insights it provides, identifying areas for improvement, and implementing actionable strategies, businesses can harness the power of cash flow to navigate the challenges and seize the opportunities that lie ahead.

%20(1).png)

Closure

Thus, we hope this article has provided valuable insights into Unlocking Profitability: 5 Key Insights from a Powerful Cash Flow Statement. We appreciate your attention to our article. See you in our next article!

google.com