Unlocking 5 Powerful Real Estate Tax Benefits: Your Guide to Saving Big

Related Articles: Unlocking 5 Powerful Real Estate Tax Benefits: Your Guide to Saving Big

- 5 Unforgettable Locations For Your Dream Home: A Guide To The World’s Most Incredible Real Estate

- 5 Powerful Real Estate Financing Options To Unlock Your Dream Home

- 7 Explosive Strategies To Sell Your Home In A Flash!

- 5 Ways REITs Can Power Your Portfolio: A Proven Path To Passive Income

- The Booming 5-Year Outlook: A Powerful Real Estate Market Analysis

Introduction

With great pleasure, we will explore the intriguing topic related to Unlocking 5 Powerful Real Estate Tax Benefits: Your Guide to Saving Big. Let’s weave interesting information and offer fresh perspectives to the readers.

Unlocking 5 Powerful Real Estate Tax Benefits: Your Guide to Saving Big

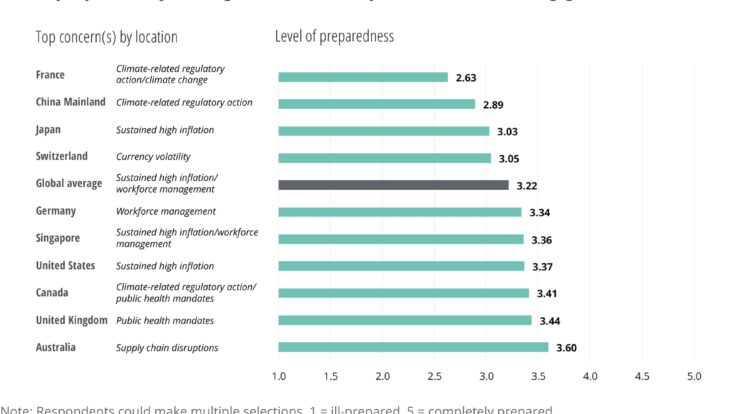

Owning real estate can be a rewarding experience, but it also comes with its share of financial responsibilities. One of the biggest expenses you’ll face is property taxes, which can significantly impact your bottom line. Fortunately, there are several tax benefits available to homeowners and investors that can help you save money and maximize your returns.

This article will explore five powerful real estate tax benefits that you can leverage to your advantage. We’ll delve into the specifics of each benefit, providing clear explanations and practical examples to help you understand how they work and how to qualify.

1. The Homeowner’s Exemption: A Tax Break for Everyone

The homeowner’s exemption is a widely available tax break that offers a reduction in your property taxes based on the fact that you reside in the property. It’s a crucial benefit that provides significant savings for homeowners, especially those on fixed incomes or with limited financial resources.

How it Works:

- The homeowner’s exemption is typically a fixed dollar amount that is deducted from your assessed property value, resulting in lower property taxes.

- The specific exemption amount varies from jurisdiction to jurisdiction, but it’s often determined by factors like the property’s assessed value, your income, and your family size.

- To qualify for the homeowner’s exemption, you must be the primary resident of the property and meet other eligibility criteria set by your local government.

Example:

Let’s say your property’s assessed value is $300,000, and your local homeowner’s exemption is $5,000. This means your taxable value will be reduced to $295,000, resulting in lower property taxes.

2. The Homestead Exemption: A Benefit for Primary Residences

The homestead exemption is another common tax break that specifically applies to your primary residence. This exemption allows you to reduce your taxable property value, leading to lower property taxes.

How it Works:

- The homestead exemption is typically a fixed dollar amount or a percentage of the property’s value that is exempt from taxation.

- The specific exemption amount and eligibility criteria vary depending on your location. Some states offer a larger exemption for seniors or disabled individuals.

Example:

Suppose your property’s assessed value is $400,000, and your state offers a homestead exemption of 10% of the property’s value. In this case, you would receive a $40,000 exemption, reducing your taxable value to $360,000, resulting in lower property taxes.

3. The Mortgage Interest Deduction: A Significant Savings for Homeowners

The mortgage interest deduction is one of the most valuable tax benefits for homeowners, allowing you to deduct the interest you pay on your mortgage from your taxable income. This can lead to substantial tax savings, especially in the early years of your mortgage when interest payments are higher.

How it Works:

- You can deduct the interest paid on up to $750,000 of mortgage debt for loans acquired after December 15, 2017. For loans acquired before that date, the limit is $1 million.

- This deduction is available for both primary residences and second homes.

- To claim the mortgage interest deduction, you must itemize your deductions on your tax return instead of taking the standard deduction.

Example:

If you paid $10,000 in mortgage interest during the year, you can deduct that amount from your taxable income, potentially reducing your tax liability by hundreds or even thousands of dollars.

4. Property Tax Deduction: Offset Your Property Taxes

The property tax deduction allows you to deduct a portion of your property taxes from your federal income tax liability. This benefit can help offset the cost of your property taxes, reducing your overall tax burden.

How it Works:

- The property tax deduction is limited to $10,000 per household, meaning you can only deduct up to $10,000 in property taxes paid annually.

- Like the mortgage interest deduction, you must itemize your deductions on your tax return to claim this benefit.

Example:

If you paid $12,000 in property taxes during the year, you can deduct $10,000 from your taxable income, potentially saving you a significant amount on your federal income taxes.

5. Capital Gains Exclusion: A Tax-Free Profit on Your Home Sale

The capital gains exclusion allows you to exclude a portion of the profit you make from selling your primary residence from your taxable income. This benefit can help you avoid paying capital gains taxes on a substantial portion of your home’s sale proceeds.

How it Works:

- You can exclude up to $250,000 in capital gains if you are single or $500,000 if you are married filing jointly.

- To qualify for the capital gains exclusion, you must have lived in the property for at least two of the five years preceding the sale.

- This benefit is only available for your primary residence and cannot be used for investment properties or second homes.

Example:

Let’s say you sell your home for $500,000 and your original purchase price was $250,000. This means you have a capital gain of $250,000. Since you have lived in the property for more than two years, you can exclude the entire $250,000 gain from your taxable income, avoiding any capital gains taxes.

Maximizing Your Tax Benefits:

- Keep Accurate Records: It’s essential to maintain detailed records of all your real estate expenses, including mortgage interest, property taxes, insurance premiums, and home improvement costs. This documentation will help you claim all the tax benefits you qualify for.

- Consult a Tax Professional: Seeking advice from a qualified tax professional can help you navigate the complexities of real estate tax benefits and ensure you are maximizing your savings.

- Understand Local Regulations: The availability and specifics of real estate tax benefits can vary depending on your state and local jurisdiction. It’s crucial to familiarize yourself with the regulations in your area to ensure you are taking full advantage of all available benefits.

Conclusion:

Real estate tax benefits can significantly reduce your tax burden and help you save money on your home ownership expenses. By understanding and utilizing these benefits, you can maximize your financial returns and enjoy the full benefits of owning real estate. Remember to stay informed about the latest tax regulations and seek professional advice to ensure you are taking full advantage of all available opportunities.

Closure

Thus, we hope this article has provided valuable insights into Unlocking 5 Powerful Real Estate Tax Benefits: Your Guide to Saving Big. We appreciate your attention to our article. See you in our next article!

Sponsored Website: paid4link.com