Unlocking 5 Powerful Business Financial Ratios: A Guide to Uncover Hidden Truths

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unlocking 5 Powerful Business Financial Ratios: A Guide to Uncover Hidden Truths. Let’s weave interesting information and offer fresh perspectives to the readers.

Unlocking 5 Powerful Business Financial Ratios: A Guide to Uncover Hidden Truths

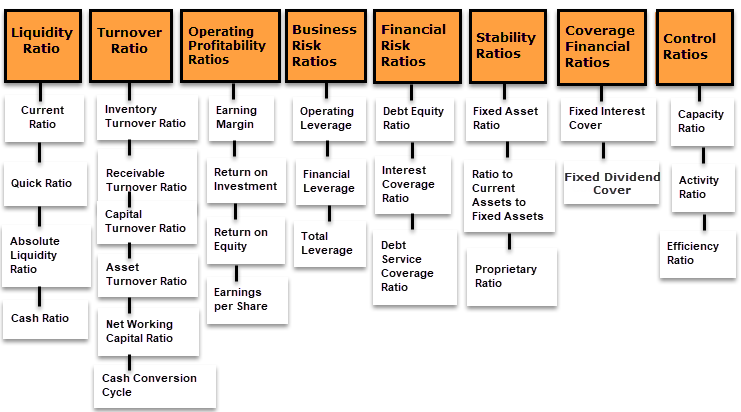

Financial ratios are the unsung heroes of business analysis. They offer a powerful lens through which to dissect a company’s performance, revealing insights that raw numbers alone cannot. These ratios, when used strategically, can help you understand a company’s profitability, liquidity, solvency, efficiency, and overall financial health.

This article delves into five key financial ratios, exploring their significance and how they can be leveraged to make informed business decisions.

1. Profitability Ratios: Unveiling the Heart of a Business

Profitability ratios are the ultimate measure of a company’s ability to generate profits from its operations. They reveal the effectiveness of a company’s management in utilizing its assets and controlling expenses.

-

Gross Profit Margin: This ratio calculates the percentage of each sales dollar that remains after accounting for the cost of goods sold. It offers a clear picture of the company’s ability to manage its production costs and pricing strategy.

Formula: Gross Profit Margin = (Gross Profit / Revenue) x 100

Interpretation: A higher gross profit margin indicates better cost control and potentially higher pricing power. A declining gross profit margin could signal rising input costs, competitive pressure, or inefficient production processes.

-

Operating Profit Margin: This ratio measures the percentage of revenue remaining after deducting operating expenses, such as salaries, rent, and utilities. It highlights the company’s operational efficiency and its ability to control costs.

Formula: Operating Profit Margin = (Operating Income / Revenue) x 100

Interpretation: A high operating profit margin suggests efficient operations and a strong competitive position. A declining operating profit margin could indicate rising operating costs or a decline in pricing power.

-

Net Profit Margin: This ratio reveals the percentage of revenue remaining after all expenses, including interest and taxes, have been deducted. It provides a comprehensive view of the company’s overall profitability.

Formula: Net Profit Margin = (Net Income / Revenue) x 100

Interpretation: A higher net profit margin indicates a more profitable business. A declining net profit margin could signal issues with cost control, revenue generation, or both.

2. Liquidity Ratios: Gauging the Company’s Cash Flow

Liquidity ratios measure a company’s ability to meet its short-term financial obligations, ensuring it has sufficient cash on hand to pay its bills. These ratios are crucial for assessing the company’s financial stability and its ability to manage unexpected expenses.

-

Current Ratio: This ratio compares a company’s current assets (assets expected to be converted to cash within a year) to its current liabilities (short-term debts due within a year).

Formula: Current Ratio = Current Assets / Current Liabilities

Interpretation: A current ratio of 2 or higher generally indicates sufficient liquidity. A ratio below 1 suggests potential difficulties in meeting short-term obligations.

-

Quick Ratio (Acid Test Ratio): This ratio is similar to the current ratio but excludes inventory, which can be harder to liquidate quickly. It provides a more conservative measure of a company’s immediate liquidity.

Formula: Quick Ratio = (Current Assets – Inventory) / Current Liabilities

Interpretation: A quick ratio of 1 or higher is considered healthy. A ratio below 1 indicates potential liquidity problems.

-

Cash Ratio: This ratio offers the most conservative measure of liquidity, comparing cash and cash equivalents to current liabilities.

Formula: Cash Ratio = (Cash + Cash Equivalents) / Current Liabilities

Interpretation: A cash ratio of 0.5 or higher is generally considered strong. A ratio below 0.5 suggests a company may struggle to meet its immediate financial obligations.

3. Solvency Ratios: Examining the Company’s Long-Term Stability

Solvency ratios assess a company’s ability to meet its long-term financial obligations, including debt payments. They are crucial for understanding a company’s financial stability and its ability to weather economic downturns.

-

Debt-to-Equity Ratio: This ratio compares a company’s total debt to its total equity. It measures the extent to which the company relies on debt financing.

Formula: Debt-to-Equity Ratio = Total Debt / Total Equity

Interpretation: A lower debt-to-equity ratio indicates a company is less reliant on debt and is considered more financially stable. A high ratio could suggest a higher risk of financial distress.

-

Times Interest Earned Ratio: This ratio measures a company’s ability to cover its interest expenses with its operating income. It provides insight into the company’s ability to service its debt obligations.

Formula: Times Interest Earned Ratio = Operating Income / Interest Expense

Interpretation: A times interest earned ratio of 2 or higher is generally considered healthy. A ratio below 1 suggests the company may struggle to meet its interest payments.

-

Debt-to-Asset Ratio: This ratio measures the proportion of a company’s assets financed by debt. It reflects the overall financial leverage employed by the company.

Formula: Debt-to-Asset Ratio = Total Debt / Total Assets

Interpretation: A lower debt-to-asset ratio indicates a company is less reliant on debt financing and is considered less risky. A higher ratio suggests a higher level of financial leverage.

4. Efficiency Ratios: Evaluating Operational Effectiveness

Efficiency ratios measure how effectively a company uses its assets and resources to generate sales and profits. They provide insights into the company’s operational efficiency and its ability to manage its assets effectively.

-

Inventory Turnover Ratio: This ratio measures how quickly a company sells its inventory. It reflects the efficiency of inventory management and the demand for the company’s products.

Formula: Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory

Interpretation: A higher inventory turnover ratio indicates efficient inventory management and strong demand. A low ratio could suggest slow-moving inventory, obsolescence, or weak demand.

-

Days Sales Outstanding (DSO): This ratio measures the average number of days it takes a company to collect its receivables. It provides insights into the company’s credit policies and its ability to collect payments from customers.

Formula: DSO = (Average Accounts Receivable / Revenue) x 365

Interpretation: A lower DSO indicates efficient credit management and timely collection of payments. A high DSO could suggest lenient credit policies or difficulty in collecting receivables.

-

Asset Turnover Ratio: This ratio measures how effectively a company uses its assets to generate revenue. It reflects the company’s ability to generate sales from its assets.

Formula: Asset Turnover Ratio = Revenue / Average Total Assets

Interpretation: A higher asset turnover ratio indicates efficient asset utilization and strong revenue generation. A low ratio could suggest inefficient asset management or low demand for the company’s products.

5. Valuation Ratios: Assessing the Company’s Market Value

Valuation ratios compare a company’s market value to its financial performance. They provide insights into how investors perceive the company’s future prospects and its potential for growth.

-

Price-to-Earnings (P/E) Ratio: This ratio compares a company’s share price to its earnings per share. It reflects the market’s expectations for the company’s future profitability.

Formula: P/E Ratio = Share Price / Earnings Per Share

Interpretation: A higher P/E ratio suggests investors are willing to pay a premium for the company’s future earnings. A low P/E ratio could indicate a lack of investor confidence or a potential undervaluation.

-

Price-to-Book (P/B) Ratio: This ratio compares a company’s share price to its book value per share. It reflects the market’s assessment of the company’s assets and its ability to generate returns.

Formula: P/B Ratio = Share Price / Book Value Per Share

Interpretation: A P/B ratio above 1 suggests the market values the company’s assets at a premium to their book value. A P/B ratio below 1 could indicate a potential undervaluation or a decline in asset quality.

-

Dividend Yield: This ratio measures the annual dividend paid per share as a percentage of the share price. It reflects the company’s dividend policy and its ability to return value to shareholders.

Formula: Dividend Yield = Annual Dividend Per Share / Share Price

Interpretation: A higher dividend yield indicates a more generous dividend policy and potentially a more mature company. A low dividend yield could suggest a focus on reinvesting profits for growth or a lack of profitability.

Using Financial Ratios to Make Informed Decisions

Financial ratios are powerful tools for gaining a deeper understanding of a company’s financial health and performance. However, it’s important to use them strategically and with a critical eye. Here are some key considerations:

- Context is Key: Ratios should be analyzed within the context of the company’s industry, its competitors, and its overall business environment.

- Trend Analysis: Tracking ratios over time can reveal important trends and potential areas of concern.

- Comparison: Comparing a company’s ratios to industry averages and competitor benchmarks provides valuable insights into its relative performance.

- Qualitative Factors: Financial ratios should be considered alongside qualitative factors, such as management quality, competitive landscape, and industry outlook.

By leveraging the power of financial ratios, you can gain a deeper understanding of a company’s strengths and weaknesses, make more informed investment decisions, and identify potential opportunities for improvement.

Closure

Thus, we hope this article has provided valuable insights into Unlocking 5 Powerful Business Financial Ratios: A Guide to Uncover Hidden Truths. We thank you for taking the time to read this article. See you in our next article!

google.com