Unleash the Power of Real-Time Forex: 10 Things You Need to Know

Related Articles: Unleash the Power of Real-Time Forex: 10 Things You Need to Know

- 5 Unstoppable Forex Brokers: Dominate The Market With These Powerful Platforms

- 5 Crucial Steps To Master The Ultimate Forex Trading Course: Unlocking Financial Freedom

- 5 Unstoppable Forex Trading Tips To Dominate The Market

- 5 Unforgettable Forex Trading Platforms: Empowering Your Financial Journey

- 5 Crucial Steps To Master The Exciting World Of Forex Trading

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unleash the Power of Real-Time Forex: 10 Things You Need to Know. Let’s weave interesting information and offer fresh perspectives to the readers.

Unleash the Power of Real-Time Forex: 10 Things You Need to Know

The global foreign exchange market, a behemoth of trillions of dollars traded daily, thrives on constant movement. Understanding these dynamic live forex rates is crucial for anyone involved in international trade, investment, or simply curious about the world’s financial heartbeat. This article delves into the intricacies of live forex rates, revealing 10 essential points that empower you to navigate this complex yet exciting arena.

1. The Foundation: What are Live Forex Rates?

Live forex rates represent the instantaneous price of one currency against another. Think of them as a constantly fluctuating exchange rate displayed in real-time. These rates are driven by a multitude of factors, including:

- Economic Data: News releases about inflation, interest rates, and economic growth in major economies can significantly impact currency valuations.

- Political Events: Geopolitical events, such as elections, trade wars, or international conflicts, can trigger volatility in currency markets.

- Market Sentiment: Investor confidence and speculation play a significant role in determining currency prices.

- Central Bank Actions: Monetary policy decisions made by central banks, such as interest rate adjustments or currency interventions, can influence forex rates.

2. The Importance of Real-Time Information

In the fast-paced world of forex trading, having access to live forex rates is paramount. Delayed information can lead to missed opportunities or, worse, costly mistakes. Real-time data empowers traders to:

- Make Informed Decisions: Live rates provide a snapshot of the current market conditions, allowing traders to identify potential entry and exit points.

- Execute Orders Quickly: In the blink of an eye, currency values can shift, and real-time data ensures traders can act swiftly to capitalize on these movements.

- Minimize Risk: By staying abreast of live rates, traders can monitor their positions and adjust their strategies to mitigate potential losses.

3. Understanding the Terminology: Base Currency and Quote Currency

Live forex rates are always expressed as a pair, with one currency acting as the base and the other as the quote. For instance, in the EUR/USD pair:

- EUR (Euro): Base currency. Its value is fixed at 1.

- USD (US Dollar): Quote currency. Its value fluctuates against the Euro.

The quote currency tells you how much of that currency you’ll receive for one unit of the base currency.

4. The Power of Currency Pairs:

The forex market is a tapestry of numerous currency pairs, each with its unique characteristics and volatility. Understanding the dynamics of these pairs is crucial for successful trading:

- Major Pairs: These involve the US dollar paired with currencies like the Euro, Japanese Yen, British Pound, Australian Dollar, and Canadian Dollar. They are highly liquid and generally experience larger trading volumes.

- Minor Pairs: These involve less traded currencies against the US dollar, such as the Swiss Franc, New Zealand Dollar, and Scandinavian currencies.

- Exotic Pairs: These pairs involve non-major currencies against each other, often exhibiting higher volatility and less liquidity.

5. Forex Quotes: Bid and Ask Prices

When you see live forex rates, you’ll typically encounter two prices:

- Bid Price: This is the price at which a market maker is willing to buy a currency.

- Ask Price: This is the price at which a market maker is willing to sell a currency.

The difference between the bid and ask price is called the spread. This spread represents the profit margin for market makers.

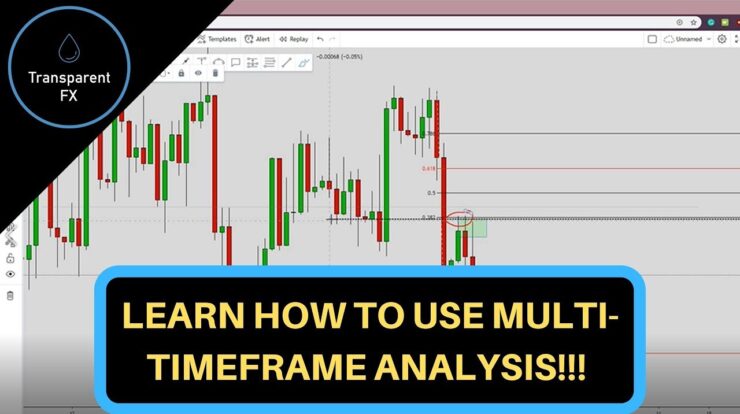

6. Charting and Technical Analysis

Visualizing live forex rates through charts is essential for technical analysis. Charts provide a graphical representation of price movements over time, enabling traders to:

- Identify Trends: Charts can reveal upward or downward trends in currency values, providing insights into market sentiment.

- Spot Patterns: Certain chart patterns, such as head and shoulders or double bottoms, can signal potential price reversals.

- Apply Indicators: Technical indicators, such as moving averages and Bollinger Bands, can help identify overbought or oversold conditions and predict future price movements.

7. The Role of Fundamental Analysis

While technical analysis focuses on chart patterns, fundamental analysis examines the underlying economic and political factors that influence currency valuations. This involves:

- Economic Data: Tracking economic indicators like inflation, GDP growth, unemployment rates, and interest rates can provide insights into a currency’s strength.

- Political Events: Monitoring political developments, such as elections, policy changes, and geopolitical tensions, can help assess a currency’s future trajectory.

- Central Bank Policies: Understanding the actions and statements of central banks, including interest rate decisions and currency interventions, can provide valuable clues about currency valuations.

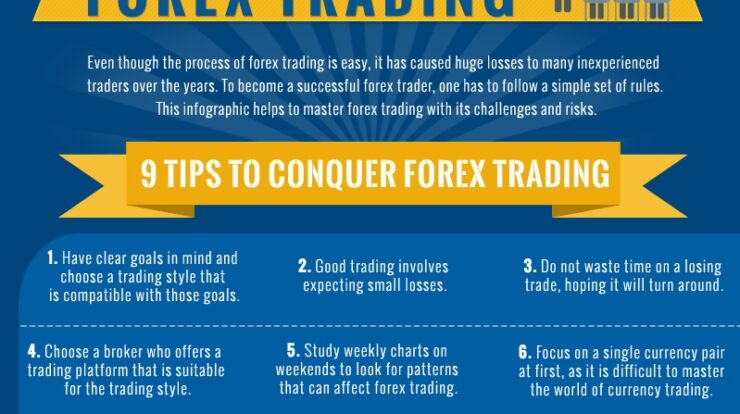

8. Risks and Rewards in Forex Trading

Forex trading, like any investment, involves inherent risks. It’s crucial to understand and manage these risks effectively:

- Volatility: Currency prices can fluctuate rapidly, potentially leading to significant losses.

- Leverage: Forex trading often involves leverage, which can amplify both profits and losses.

- Market Liquidity: Fluctuations in liquidity can affect the ability to execute trades at desired prices.

9. Trading Platforms and Brokers

To access live forex rates and execute trades, you’ll need a trading platform and a broker.

- Trading Platforms: These platforms provide real-time market data, charting tools, and order execution capabilities. Popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

- Brokers: These firms provide access to the forex market and facilitate your trades. Choose a reputable broker with strong regulatory oversight and competitive trading conditions.

10. The Importance of Continuous Learning

The forex market is a dynamic and ever-evolving environment. Continuously expanding your knowledge through:

- Education: Enroll in forex courses, read books and articles, and attend webinars to deepen your understanding.

- Practice: Use demo accounts to test trading strategies and gain experience before risking real capital.

- Market Research: Stay informed about global economic events, political developments, and central bank policies.

Conclusion

Navigating the world of live forex rates requires a blend of knowledge, skill, and discipline. By understanding the fundamentals, employing technical and fundamental analysis, and managing risks effectively, you can unlock the potential of this dynamic market. Remember, the key to success in forex trading is continuous learning, adaptability, and a commitment to responsible trading practices.

Closure

Thus, we hope this article has provided valuable insights into Unleash the Power of Real-Time Forex: 10 Things You Need to Know. We appreciate your attention to our article. See you in our next article!

Sponsored Website: paid4link.com