5 Essential Business Legal Forms: A Powerful Guide to Success

Introduction

With great pleasure, we will explore the intriguing topic related to 5 Essential Business Legal Forms: A Powerful Guide to Success. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Essential Business Legal Forms: A Powerful Guide to Success

Choosing the right legal form for your business is a crucial step towards its success. It impacts everything from liability to taxes, and even the way your business is perceived by investors and customers. This article provides a comprehensive guide to five essential business legal forms, highlighting their advantages and disadvantages, and helping you make an informed decision that aligns with your business goals.

1. Sole Proprietorship: The Simplest Form

The sole proprietorship is the simplest and most common business structure. It involves one individual owning and operating the business, with no legal distinction between the owner and the business.

Advantages:

- Easy to Set Up: Minimal paperwork and registration requirements.

- Complete Control: The owner has full control over all aspects of the business.

- Tax Advantages: Profits and losses are reported on the owner’s personal income tax return, simplifying tax filing.

Disadvantages:

- Unlimited Liability: The owner is personally liable for all business debts and obligations, putting personal assets at risk.

- Limited Funding: Access to capital can be challenging due to the limited legal structure.

- Lack of Continuity: The business ceases to exist if the owner dies or becomes incapacitated.

2. Partnership: Sharing the Load

A partnership involves two or more individuals who agree to share in the profits and losses of a business. There are several types of partnerships, including general partnerships, limited partnerships, and limited liability partnerships.

Advantages:

- Shared Resources: Partners can pool their resources, expertise, and networks.

- Tax Advantages: Profits and losses are distributed among partners and reported on their individual tax returns.

- Increased Flexibility: Partners can structure their partnership agreement to address specific needs and goals.

Disadvantages:

- Unlimited Liability (General Partnerships): General partners are personally liable for all business debts and obligations.

- Potential for Conflict: Disagreements among partners can lead to legal disputes.

- Limited Life: The partnership dissolves if a partner leaves or dies, unless the partnership agreement provides for continuation.

3. Limited Liability Company (LLC): The Hybrid Option

An LLC combines the advantages of a sole proprietorship and a corporation. It offers limited liability protection for its owners (called members) while allowing for flexible tax treatment.

Advantages:

- Limited Liability: Members are not personally liable for business debts and obligations, protecting their personal assets.

- Tax Flexibility: LLCs can choose to be taxed as a partnership (pass-through taxation) or as a corporation.

- Operational Flexibility: LLCs can be managed by members or by a manager appointed by the members.

Disadvantages:

- Formation Costs: Setting up an LLC typically involves higher costs compared to a sole proprietorship or partnership.

- Compliance Requirements: LLCs need to comply with state regulations, including annual reporting and record-keeping.

- Limited Access to Capital: Securing funding can be more challenging compared to corporations.

4. Corporation: The Powerhouse of Business

A corporation is a separate legal entity from its owners (shareholders), offering the highest level of liability protection and access to capital.

Advantages:

- Limited Liability: Shareholders are not personally liable for business debts and obligations.

- Access to Capital: Corporations can raise capital through the sale of stock.

- Perpetual Existence: Corporations can continue to exist even if shareholders change.

Disadvantages:

- Complex Formation: Setting up a corporation involves more paperwork and legal requirements.

- Double Taxation: Corporations are taxed on their profits, and shareholders are taxed again on dividends received.

- Regulatory Compliance: Corporations face more stringent regulations and reporting requirements.

5. Nonprofit Organization: Making a Difference

A nonprofit organization is a legal entity formed to serve a public benefit, not for profit. They operate on a mission-driven basis and rely on donations, grants, and membership fees for funding.

Advantages:

- Tax-Exempt Status: Nonprofits are exempt from paying federal income tax and may be eligible for state and local tax exemptions.

- Public Support: Nonprofits can attract public support and donations due to their mission-driven focus.

- Social Impact: Nonprofits play a vital role in addressing social and environmental issues.

Disadvantages:

- Limited Funding: Nonprofits rely heavily on donations and grants, which can be unpredictable.

- Strict Regulations: Nonprofits face stringent regulations regarding their operations and finances.

- Limited Profit Potential: Nonprofits are not allowed to distribute profits to their members or directors.

Choosing the Right Legal Form

The best legal form for your business depends on a number of factors, including:

- Liability concerns: Do you need to protect your personal assets from business debts?

- Tax implications: How will your business be taxed?

- Funding needs: How will you raise capital for your business?

- Management structure: Who will be responsible for managing the business?

- Long-term goals: What are your plans for the future of your business?

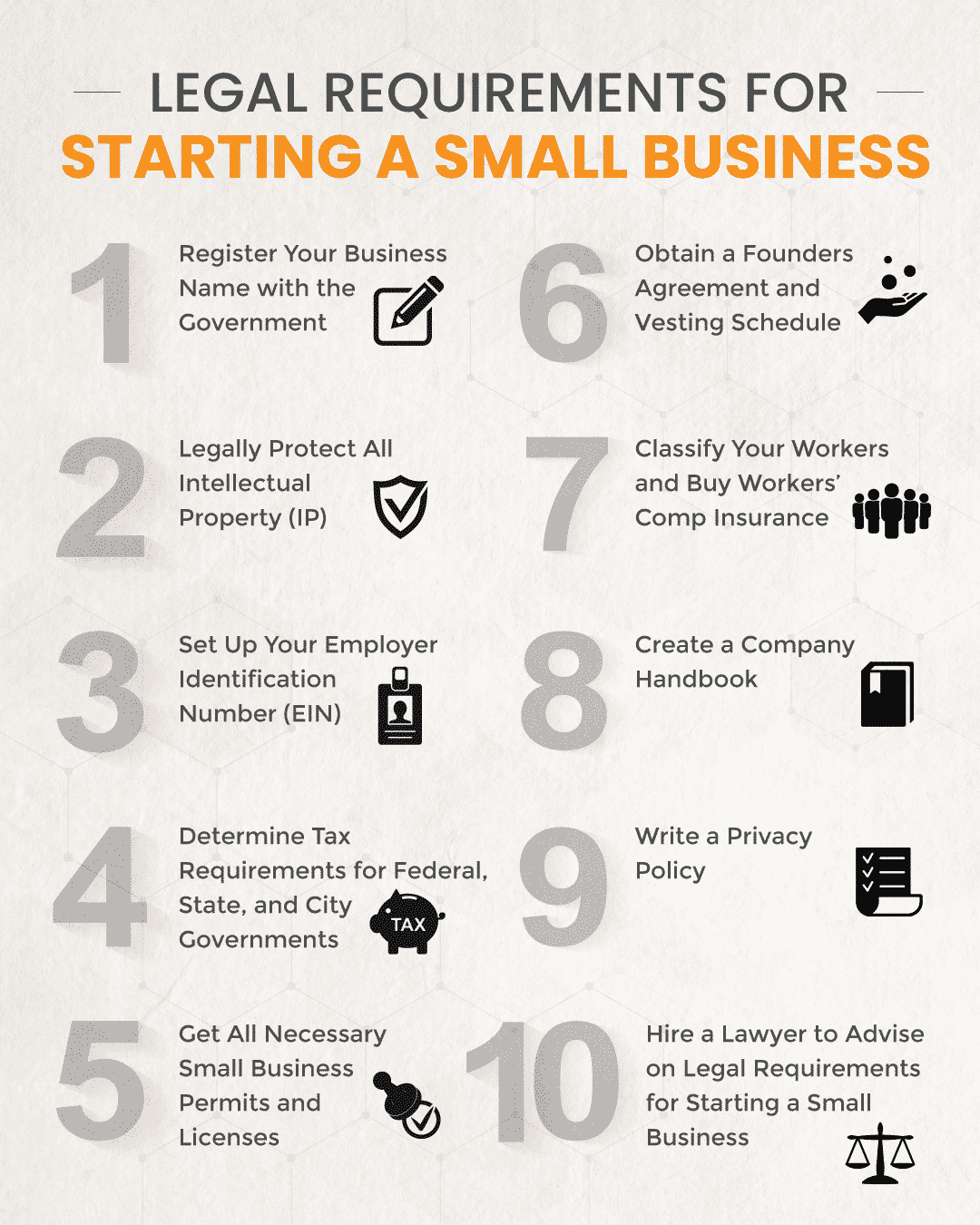

Professional Advice

It is essential to consult with a qualified attorney or business advisor to determine the most appropriate legal form for your specific business needs. They can provide expert guidance on the legal and tax implications of each option and help you create a business structure that aligns with your goals and minimizes risk.

Conclusion

Choosing the right legal form is a critical decision for any business owner. By understanding the advantages and disadvantages of each form, and by seeking professional advice, you can create a strong foundation for your business’s success. Remember, the right legal form can empower you to navigate the complexities of the business world and achieve your goals with confidence.

Closure

Thus, we hope this article has provided valuable insights into 5 Essential Business Legal Forms: A Powerful Guide to Success. We hope you find this article informative and beneficial. See you in our next article!

google.com