5 Crucial Business Insurance Coverages You Can’t Afford to Ignore

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Crucial Business Insurance Coverages You Can’t Afford to Ignore. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Crucial Business Insurance Coverages You Can’t Afford to Ignore

The world of business is inherently risky. From unexpected accidents to unforeseen lawsuits, a multitude of threats can derail your hard-earned success. While you can’t predict the future, you can prepare for it. And one of the most powerful ways to safeguard your business is through comprehensive insurance coverage.

This article will delve into five essential insurance coverages that every business owner should consider, regardless of industry or size. By understanding these crucial protections, you can build a solid foundation for resilience and peace of mind.

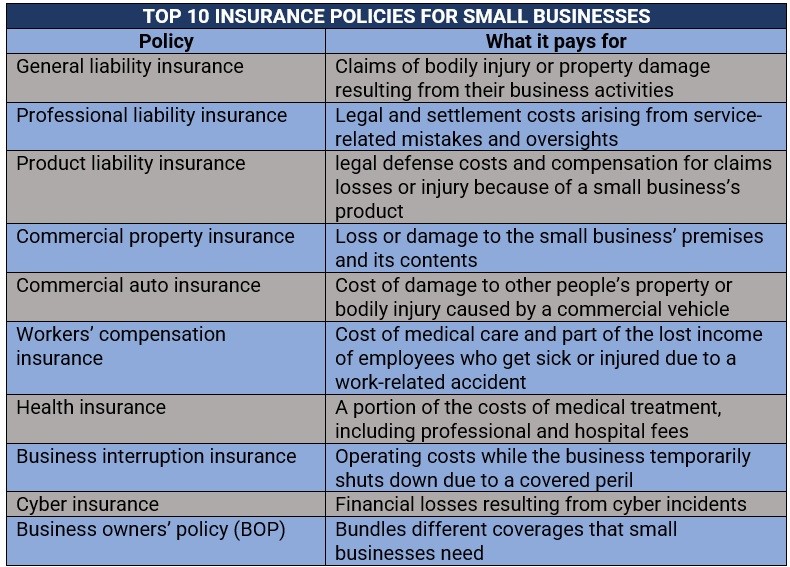

1. General Liability Insurance: A Safety Net for Unforeseen Accidents

General liability insurance is often considered the cornerstone of business insurance. It acts as a safety net, protecting your business from financial ruin in the event of accidents or injuries that occur on your property or in the course of your business operations.

What does it cover?

- Bodily injury: If a customer or visitor is injured on your premises, general liability insurance covers medical expenses, legal fees, and potential settlements.

- Property damage: If your business operations accidentally damage someone else’s property, this coverage helps cover the cost of repairs or replacement.

- Advertising injury: This covers situations where your business’s advertising or marketing materials cause harm to someone’s reputation or business interests.

- Product liability: If your product causes injury or damage, this coverage protects your business from lawsuits and related expenses.

Why is it essential?

Imagine a customer slips and falls on a wet floor in your store, sustaining a serious injury. Without general liability insurance, you could be held personally responsible for their medical bills, legal fees, and potential compensation. This could lead to significant financial hardship, potentially even forcing you to close your doors.

2. Property Insurance: Protecting Your Business Assets

Your business assets, including your building, equipment, inventory, and even valuable documents, represent a significant investment. Property insurance safeguards these assets against a wide range of perils, ensuring your business can recover from unexpected events.

What does it cover?

- Fire and smoke damage: This coverage protects your business from losses caused by fires, explosions, and smoke damage.

- Windstorm and hail damage: If your building is damaged by strong winds, hailstorms, or other weather-related events, this coverage provides financial assistance for repairs.

- Vandalism and theft: Property insurance helps cover losses from vandalism, burglary, and theft of your business property.

- Natural disasters: Depending on your location and the specific policy, property insurance can cover damage caused by earthquakes, floods, hurricanes, and other natural disasters.

Why is it essential?

Imagine a fire erupts in your office, destroying valuable equipment and important documents. Without property insurance, you could face a devastating financial loss, potentially crippling your business. Property insurance helps you rebuild and recover from such disasters, allowing you to continue operating.

3. Workers’ Compensation Insurance: Protecting Your Employees

Workers’ compensation insurance is a legal requirement in most states, and for good reason. It protects your business from financial liability if an employee is injured or becomes ill while on the job.

What does it cover?

- Medical expenses: This covers the cost of medical treatment, including doctor visits, hospital stays, and rehabilitation.

- Lost wages: Workers’ compensation insurance provides partial income replacement for employees who are unable to work due to work-related injuries or illnesses.

- Disability benefits: If an employee suffers a permanent disability, workers’ compensation insurance can provide ongoing financial support.

- Death benefits: In the event of an employee’s death due to a work-related injury or illness, workers’ compensation insurance can provide financial assistance to their dependents.

Why is it essential?

Imagine an employee suffers a serious injury while operating machinery in your factory. Without workers’ compensation insurance, you could face a lawsuit from the injured employee, potentially leading to significant financial penalties and legal fees. Workers’ compensation insurance protects your business from these risks and ensures your employees receive the necessary medical care and financial support.

4. Business Interruption Insurance: Bridging the Gap During Disruptions

Business interruption insurance is a vital safety net that helps businesses recover from unexpected events that disrupt their operations. It covers lost income and ongoing expenses during the period of interruption, ensuring your business can stay afloat during a challenging time.

What does it cover?

- Lost revenue: This coverage compensates for lost income due to business interruptions, such as a fire, flood, or natural disaster.

- Continuing expenses: Even when your business is closed, you still have ongoing expenses like rent, utilities, and employee salaries. Business interruption insurance helps cover these expenses during the downtime.

- Extra expenses: If you need to relocate your business temporarily or invest in additional equipment to resume operations, business interruption insurance can help cover these extra costs.

Why is it essential?

Imagine a major power outage shuts down your operations for several days. Without business interruption insurance, you could lose significant revenue and struggle to cover your ongoing expenses. This coverage ensures your business can weather the storm and resume operations as quickly as possible.

5. Professional Liability Insurance: Shielding You from Errors and Omissions

Professional liability insurance, also known as errors and omissions (E&O) insurance, is crucial for businesses that provide professional services, such as accountants, lawyers, consultants, and financial advisors. It protects your business from claims alleging negligence, mistakes, or omissions in your professional services.

What does it cover?

- Legal defense costs: If you are sued for professional negligence, this coverage helps cover the cost of legal representation and defense.

- Settlements and judgments: If you are found liable for professional errors or omissions, professional liability insurance helps cover the cost of settlements and court judgments.

- Reputation damage: A lawsuit or claim against your professional services can damage your reputation. Professional liability insurance can help mitigate these reputational risks.

Why is it essential?

Imagine a client sues your accounting firm for a mistake in their tax returns, resulting in a significant financial loss. Without professional liability insurance, you could face a costly lawsuit and potentially lose your business. This coverage provides peace of mind and protects your business from the financial fallout of professional errors.

Conclusion: Building a Fortress of Protection

Investing in comprehensive business insurance coverage is not an expense; it’s an investment in your business’s future. By understanding and securing the right insurance policies, you can create a fortress of protection against the unexpected, ensuring your business can weather any storm and continue to thrive. Remember, neglecting insurance can be a costly mistake, potentially leading to financial ruin. Don’t wait until it’s too late. Take proactive steps today to safeguard your business and its future.

Closure

Thus, we hope this article has provided valuable insights into 5 Crucial Business Insurance Coverages You Can’t Afford to Ignore. We appreciate your attention to our article. See you in our next article!

google.com