5 Ways to Unlock Unbeatable Business Insurance Quotes

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Ways to Unlock Unbeatable Business Insurance Quotes. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Ways to Unlock Unbeatable Business Insurance Quotes

The cost of business insurance can be a significant expense, but it’s a crucial investment that protects your company from unforeseen risks. Navigating the world of insurance quotes can feel overwhelming, but with the right approach, you can secure the best possible coverage at a competitive price. This article will guide you through five proven strategies to unlock unbeatable business insurance quotes, empowering you to make informed decisions and protect your business effectively.

1. Know Your Business Inside and Out:

The foundation of securing favorable insurance quotes lies in a thorough understanding of your own business. Before you start contacting insurance providers, take the time to analyze your operations and identify potential risks.

- Industry-Specific Risks: Every industry faces unique hazards. For example, a restaurant will have different risks than a tech startup. Research your industry’s common risks and understand how they might impact your business.

- Operational Processes: Evaluate your daily operations, identifying potential hazards within your workplace. Are there specific equipment or machinery that require specialized coverage? Do you have employees who handle sensitive information or work with hazardous materials?

- Financial Health: Your financial stability influences your insurance premiums. Have a clear picture of your revenue, expenses, and assets. This information helps you determine the appropriate level of coverage and limits.

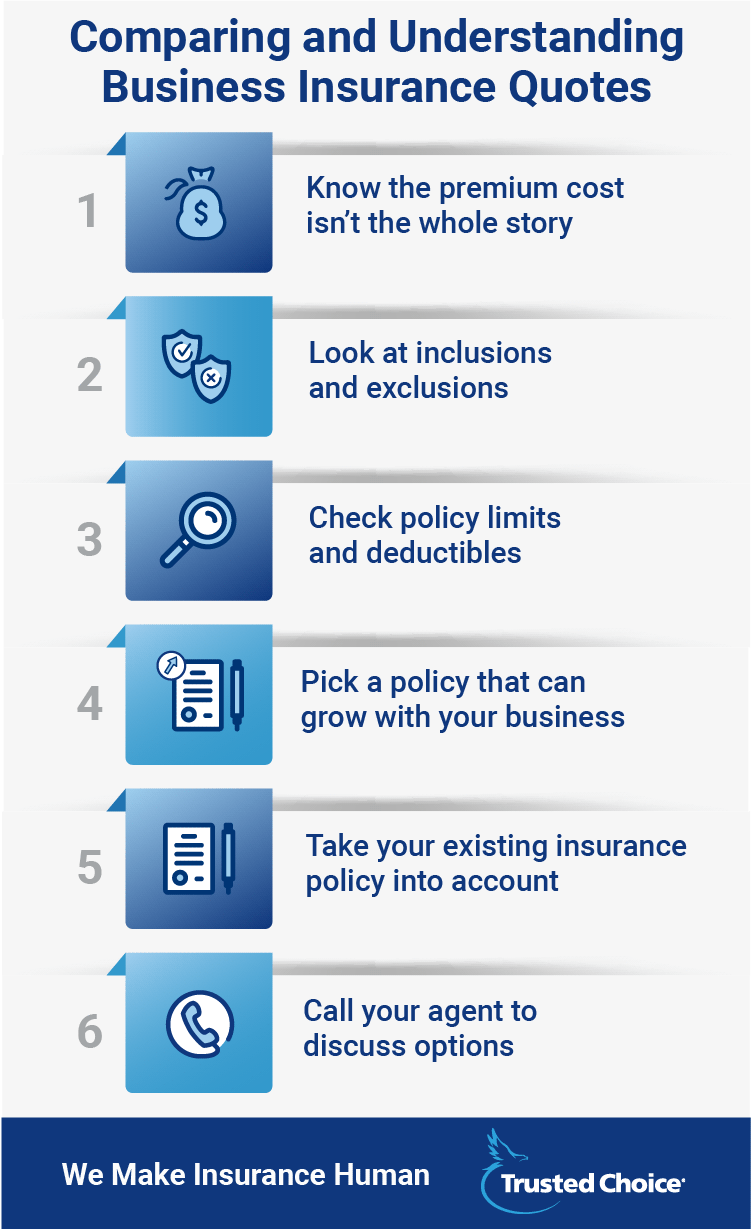

2. Shop Around and Compare Quotes:

The insurance market is competitive, and different providers offer varying rates and coverage options. Don’t settle for the first quote you receive. Take the time to shop around and compare offers from multiple insurers.

- Online Comparison Tools: Several online platforms allow you to compare quotes from various insurers simultaneously. These tools streamline the process and save you time.

- Independent Insurance Brokers: Brokers act as intermediaries, connecting you with multiple insurers and helping you navigate the complex world of insurance options. They often have access to exclusive deals and can negotiate favorable rates on your behalf.

- Direct Insurers: Many insurance companies sell policies directly to customers. Contact these companies directly to obtain quotes and compare them to broker-sourced options.

3. Leverage Your Business Credit:

Just like your personal credit score impacts your loan interest rates, your business credit score can significantly influence your insurance premiums. A strong business credit score demonstrates financial responsibility and stability, leading to potentially lower rates.

- Build a Solid Credit History: Pay bills on time, manage credit lines responsibly, and avoid excessive debt. These practices contribute to a positive credit score.

- Monitor Your Business Credit: Regularly check your business credit report for any errors or inaccuracies. Correcting mistakes can improve your score.

- Consider a Business Credit Card: Using a business credit card responsibly can help build your credit history and demonstrate financial responsibility.

4. Bundle Your Policies:

Many insurers offer discounts for bundling multiple insurance policies. If you need coverage for your business property, liability, workers’ compensation, and other risks, inquire about potential discounts for combining these policies with a single insurer.

- Explore Bundling Options: Contact insurers to discuss your specific needs and see if they offer bundled packages.

- Compare Bundled Quotes: Obtain quotes for bundled policies and compare them to individual policy quotes to determine the best value.

5. Negotiate and Ask for Discounts:

Don’t be afraid to negotiate with insurers to secure the best possible rates. There are several strategies you can use to potentially lower your premiums.

- Highlight Risk Mitigation Measures: If you’ve implemented safety protocols, security systems, or employee training programs to reduce risks, emphasize these measures to insurers. They may offer discounts for demonstrating proactive risk management.

- Ask About Discounts: Inquire about potential discounts for:

- Payment in Full: Paying your annual premium upfront may qualify you for a discount.

- Loyalty: If you’ve been a customer for a significant period, ask about loyalty discounts.

- Safety Features: If your business has security features like alarms, fire suppression systems, or surveillance cameras, inquire about discounts.

- Be Prepared to Switch Insurers: If an insurer isn’t willing to negotiate, don’t hesitate to explore other options. The competitive insurance market offers choices, and you shouldn’t settle for unfavorable terms.

Additional Tips for Unlocking Unbeatable Quotes:

- Review Your Policy Regularly: Don’t let your policy lapse. Review your coverage annually to ensure it still meets your needs. Changes in your business operations or industry regulations might necessitate adjustments to your policy.

- Seek Professional Advice: Consult with an independent insurance broker or a business insurance specialist for personalized guidance. They can help you navigate the complexities of insurance and find the most suitable coverage for your unique circumstances.

- Understand the Fine Print: Read your policy carefully and ask questions about anything you don’t understand. Be aware of any exclusions or limitations in your coverage.

Conclusion:

Securing unbeatable business insurance quotes requires a proactive approach. By understanding your business risks, shopping around, leveraging your business credit, bundling policies, and negotiating effectively, you can find the right insurance coverage at a competitive price. Remember, insurance is a vital investment that protects your business from financial hardship. Take the time to explore your options and secure the best possible protection for your company’s future.

Closure

Thus, we hope this article has provided valuable insights into 5 Ways to Unlock Unbeatable Business Insurance Quotes. We appreciate your attention to our article. See you in our next article!

google.com