5 Crucial Insights: Unlocking the Power of Business Income Statements

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Crucial Insights: Unlocking the Power of Business Income Statements. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Crucial Insights: Unlocking the Power of Business Income Statements

The income statement, also known as the profit and loss (P&L) statement, is a fundamental financial document that provides a snapshot of a company’s financial performance over a specific period. It details the revenues generated, expenses incurred, and ultimately, the net income or loss achieved. Understanding the income statement is crucial for any business owner, investor, or financial analyst, as it offers valuable insights into a company’s profitability, efficiency, and overall financial health.

Dissecting the Income Statement: A Step-by-Step Guide

The income statement follows a standardized format, typically organized into three key sections:

-

Revenue: This section represents the total income earned by the company from its primary operations. It includes sales of goods or services, as well as any other revenue streams like interest income or rental income.

-

Cost of Goods Sold (COGS): This section details the direct costs associated with producing the goods or services sold. For manufacturers, this includes raw materials, direct labor, and manufacturing overhead. For service-based businesses, it may include the cost of labor, supplies, and other directly related expenses.

-

Operating Expenses: This section covers all the indirect costs associated with running the business, excluding COGS. These expenses are categorized into various groups, including:

- Selling expenses: Costs associated with marketing, advertising, sales commissions, and distribution.

- Administrative expenses: Costs associated with general and administrative functions, such as salaries, rent, utilities, and insurance.

- Research and development expenses: Costs incurred for developing new products or processes.

Key Metrics for Analyzing Business Performance

The income statement provides valuable insights into a company’s financial performance through various key metrics:

- Gross Profit: This metric is calculated by subtracting COGS from revenue. It represents the profit generated from selling goods or services after accounting for the direct costs of production.

- Operating Income: This metric is calculated by subtracting operating expenses from gross profit. It represents the profit generated from the company’s core operations, before accounting for interest and taxes.

- Net Income: This metric is calculated by subtracting interest expenses and income taxes from operating income. It represents the company’s overall profit or loss for the period.

5 Essential Insights from the Income Statement

Analyzing the income statement can provide crucial insights into a company’s financial health and performance. Here are five key areas to focus on:

-

Profitability: The income statement reveals the company’s profitability over time. By comparing net income across different periods, you can assess whether the company is becoming more or less profitable. Trends in profitability can indicate the effectiveness of management decisions, changes in the market, or shifts in the company’s business model.

-

Cost Management: The income statement provides a detailed breakdown of the company’s expenses, allowing you to analyze cost management practices. Comparing COGS and operating expenses to revenue can reveal areas where the company might be spending too much or where cost-cutting opportunities exist.

-

Revenue Growth: Analyzing the revenue section of the income statement reveals the company’s growth trajectory. Tracking revenue growth over time can indicate the company’s ability to attract new customers, expand its market share, or introduce new products or services.

-

Operational Efficiency: The income statement can be used to assess the company’s operational efficiency by comparing its profitability to its revenue. A higher profit margin indicates that the company is generating more profit for every dollar of revenue, suggesting efficient operations and cost management.

-

Financial Health: By analyzing the income statement alongside other financial statements, such as the balance sheet and cash flow statement, you can gain a comprehensive understanding of the company’s financial health. A strong income statement, combined with a healthy balance sheet and positive cash flow, indicates a financially stable and sustainable business.

Beyond the Numbers: Understanding the Context

While the income statement provides valuable quantitative data, it’s crucial to consider the context surrounding the numbers. Factors such as industry trends, economic conditions, and company-specific events can all influence the income statement and should be taken into account during analysis.

For instance, a decline in net income might not necessarily reflect a negative trend. It could be due to a temporary economic downturn, a strategic decision to invest in growth, or a one-time expense. Understanding the context behind the numbers allows for a more nuanced and accurate interpretation of the company’s financial performance.

Conclusion: The Power of Insight

The income statement is a powerful tool for understanding a company’s financial performance. By carefully analyzing the key metrics and considering the context surrounding the numbers, you can gain valuable insights into a company’s profitability, efficiency, and overall financial health. This knowledge empowers investors, business owners, and financial analysts to make informed decisions about resource allocation, investment strategies, and overall business strategy.

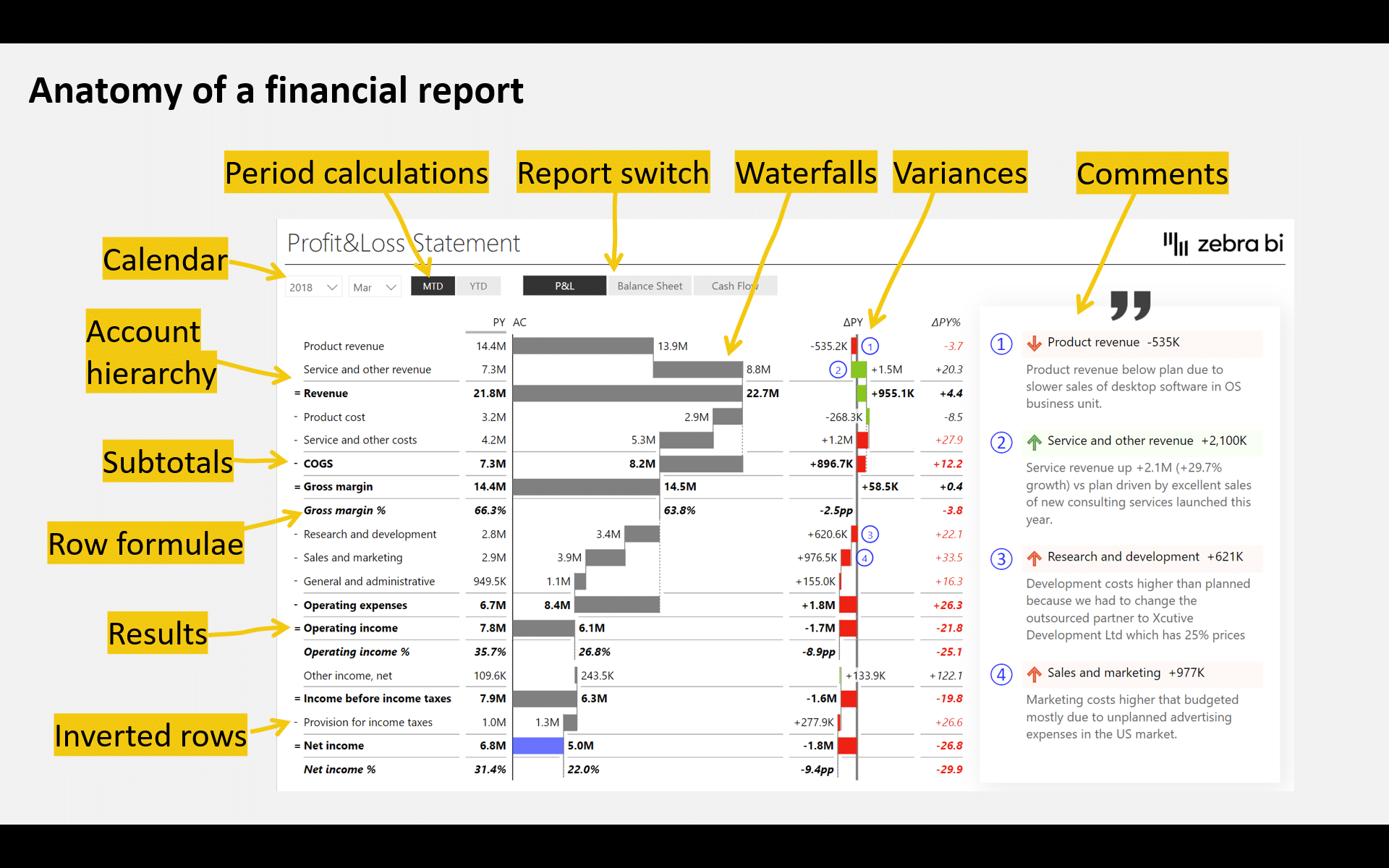

Image:

[Insert a relevant image related to financial statements, such as a graph showing income statement data, a business meeting with a financial report, or a person analyzing financial data on a computer. The image should be no larger than 740×414 pixels.]

Closure

Thus, we hope this article has provided valuable insights into 5 Crucial Insights: Unlocking the Power of Business Income Statements. We appreciate your attention to our article. See you in our next article!

google.com