5 Key Strategies for Transformative Business Banking in 2023

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 5 Key Strategies for Transformative Business Banking in 2023. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Key Strategies for Transformative Business Banking in 2023

The world of business banking is undergoing a rapid transformation. Gone are the days of rigid, inflexible services and cumbersome processes. Today, businesses demand more – they need partners who can help them thrive. This shift is driven by a confluence of factors, including:

- The rise of digital-first businesses: Entrepreneurs are increasingly tech-savvy, demanding seamless online experiences for managing finances.

- The need for agility: Businesses need to adapt quickly to changing market conditions, and their banking partners need to be equally agile.

- The importance of data: Businesses are using data to make better decisions, and their banks need to provide them with the insights they need.

- The growing importance of sustainability: Businesses are increasingly focused on sustainability, and their banks need to support them in their efforts.

In this dynamic landscape, savvy businesses are seeking out banking partners who can provide them with the tools and support they need to succeed. This article will explore five key strategies for transformative business banking in 2023, helping you navigate this evolving landscape and find the right banking partner for your business.

1. Embracing Digital Transformation:

The digital revolution has fundamentally changed the way businesses operate, and business banking is no exception. Businesses today expect seamless online experiences, and their banks need to deliver. This means offering a wide range of digital services, including:

- Online account opening: Businesses should be able to open accounts online quickly and easily.

- Mobile banking apps: Businesses need access to their accounts and financial information from anywhere, anytime.

- Digital payment solutions: Businesses need secure and efficient ways to make and receive payments.

- Real-time account information: Businesses need access to up-to-date information about their accounts, transactions, and balances.

- Automated financial reporting: Businesses need tools to generate reports and track their financial performance.

Beyond simply offering digital services, banks need to focus on user experience. This means designing intuitive and user-friendly interfaces that are easy to navigate and understand. Banks also need to provide excellent customer support, both online and offline.

2. Prioritizing Agility and Flexibility:

In today’s rapidly changing business environment, businesses need banking partners who can adapt quickly to their evolving needs. This means offering flexible products and services that can be tailored to specific business requirements.

Here are some key areas where agility is crucial:

- Loan products: Banks need to offer a variety of loan products, including short-term loans, lines of credit, and equipment financing, with flexible terms and quick approval processes.

- Payment solutions: Businesses need access to a range of payment options, including online payments, mobile payments, and international payments, with the ability to easily switch between them as their needs change.

- Financial advice: Businesses need access to expert financial advice that is tailored to their specific industry and stage of growth.

- Data analytics: Banks need to provide businesses with access to data and insights that can help them make better decisions.

Banks that prioritize agility and flexibility will be best positioned to meet the needs of businesses in the years to come.

3. Leveraging Data for Business Growth:

Data is becoming increasingly important for businesses of all sizes. Businesses are using data to understand their customers better, make more informed decisions, and improve their operations. Banks need to provide businesses with the data and insights they need to thrive.

Here are some ways banks can leverage data to support their business customers:

- Providing data analytics tools: Banks can offer businesses access to tools that can help them analyze their financial data and identify trends.

- Offering customized financial reports: Banks can provide businesses with customized financial reports that are tailored to their specific needs.

- Developing predictive models: Banks can use data to develop predictive models that can help businesses forecast future performance and identify potential risks.

- Providing personalized financial advice: Banks can use data to provide businesses with personalized financial advice that is based on their individual circumstances.

By leveraging data, banks can help businesses make better decisions, improve their performance, and achieve their goals.

4. Embracing Sustainability:

Sustainability is no longer a niche concern; it’s becoming a core business imperative. Businesses are increasingly focused on reducing their environmental impact and contributing to a more sustainable future. Banks need to support businesses in their sustainability efforts.

Here are some ways banks can embrace sustainability:

- Offering green loans: Banks can offer businesses loans specifically designed to finance sustainable projects, such as renewable energy installations or energy efficiency upgrades.

- Investing in sustainable businesses: Banks can invest in businesses that are committed to sustainability.

- Promoting sustainable practices: Banks can educate businesses about sustainable practices and encourage them to adopt them.

- Measuring and reporting on environmental impact: Banks can help businesses measure and report on their environmental impact.

By embracing sustainability, banks can help businesses create a more sustainable future for all.

5. Building Strong Customer Relationships:

In the digital age, it’s more important than ever to build strong customer relationships. Businesses want to work with banks that understand their needs and provide them with personalized support.

Here are some ways banks can build strong customer relationships:

- Offering personalized financial advice: Banks should provide businesses with financial advice that is tailored to their specific industry and stage of growth.

- Providing excellent customer service: Banks should provide businesses with prompt and helpful customer service, both online and offline.

- Building a strong online presence: Banks should have a strong online presence, including a user-friendly website and active social media accounts.

- Engaging with businesses in their communities: Banks should participate in community events and sponsor local businesses.

By building strong customer relationships, banks can earn the trust and loyalty of their business clients.

The Future of Business Banking:

The future of business banking is bright. Banks that embrace digital transformation, prioritize agility, leverage data, embrace sustainability, and build strong customer relationships will be best positioned to thrive in the years to come.

By partnering with the right banking partner, businesses can gain access to the tools and support they need to achieve their goals and thrive in the digital age.

Here are some additional tips for choosing the right business banking partner:

- Consider your business needs: What are your specific business needs? What types of services are you looking for?

- Research different banks: Compare the services and fees offered by different banks.

- Read online reviews: See what other businesses have to say about different banks.

- Talk to other business owners: Get recommendations from other business owners in your industry.

- Meet with bank representatives: Schedule meetings with representatives from different banks to discuss your needs and ask questions.

Choosing the right business banking partner is an important decision. By taking the time to research your options and carefully consider your needs, you can find a partner that will help you achieve your business goals.

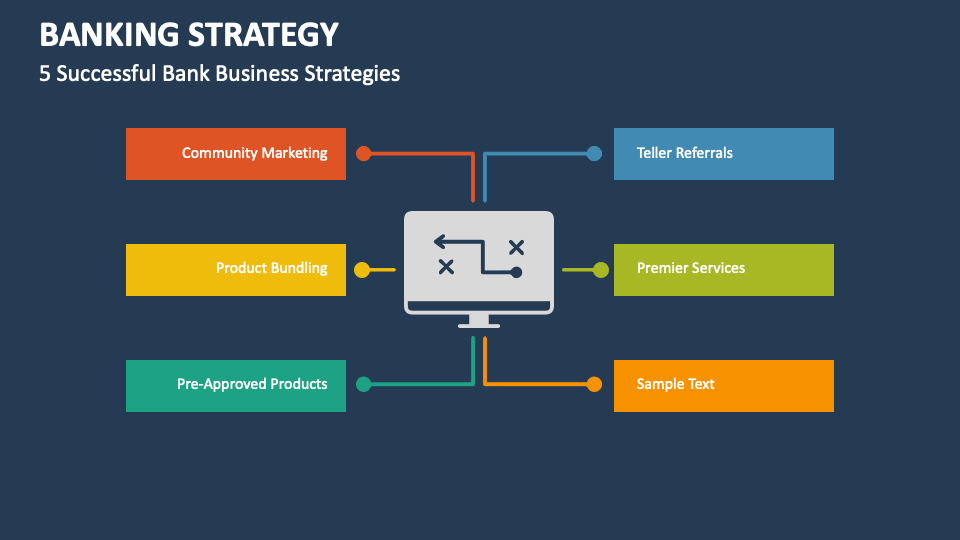

Image:

[Include an image related to business banking, such as a meeting between a business owner and a bank representative, a digital banking interface, or a chart showing financial data. Ensure the image size is no more than 740×414 pixels.]

Closure

Thus, we hope this article has provided valuable insights into 5 Key Strategies for Transformative Business Banking in 2023. We hope you find this article informative and beneficial. See you in our next article!

google.com