The Booming 5-Year Outlook: A Powerful Real Estate Market Analysis

Related Articles: The Booming 5-Year Outlook: A Powerful Real Estate Market Analysis

- 7 Powerful Negotiation Tactics To Secure Your Dream Home

- Booming 2023: The 5 Key Trends Shaping The Real Estate Market

- 5 Powerful Tips To Crush Your Real Estate Goals

- 5 Powerful Real Estate Investment Strategies For Explosive Growth

- 5 Powerful Home Staging Tips To Unleash Your Home’s Hidden Potential

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Booming 5-Year Outlook: A Powerful Real Estate Market Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

The Booming 5-Year Outlook: A Powerful Real Estate Market Analysis

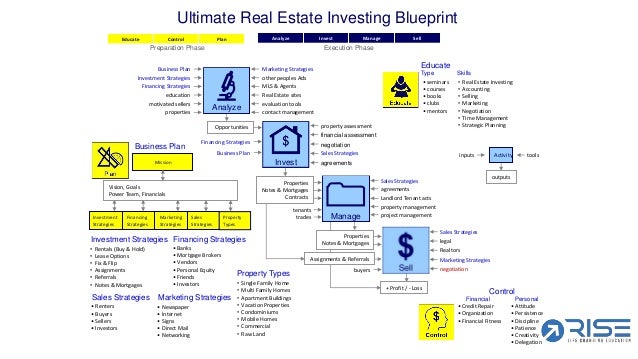

The real estate market is a dynamic and complex beast, constantly evolving with influences ranging from economic shifts to global events. However, within this complexity lies a powerful tool: market analysis. By understanding the trends, drivers, and potential pitfalls, investors and buyers alike can make informed decisions and navigate the market with confidence. This article delves into a comprehensive 5-year outlook of the real estate market, examining key factors, potential challenges, and strategic opportunities.

Understanding the Current Landscape

The global real estate market has experienced a period of significant growth in recent years, driven by factors such as low interest rates, increasing urbanization, and a strong demand for housing. However, the market is not without its challenges. Inflation, rising interest rates, and geopolitical instability have introduced a sense of uncertainty, impacting investor sentiment and market dynamics.

Key Drivers for the Next 5 Years

1. Demographic Shifts and Urbanization: The world’s population is expected to reach 9.7 billion by 2050, with a significant portion of this growth occurring in urban areas. This increasing demand for housing, particularly in major cities and suburban areas, will drive continued growth in the residential real estate sector.

2. Technological Advancements: The real estate industry is rapidly adopting new technologies, such as virtual reality tours, online platforms for property management, and data analytics for market insights. These innovations are transforming the way properties are bought, sold, and managed, leading to greater efficiency and accessibility.

3. Sustainability and Environmental Concerns: Growing awareness of climate change and sustainability is influencing real estate development. Green buildings, energy-efficient technologies, and sustainable materials are becoming increasingly sought-after, creating a niche market for environmentally conscious properties.

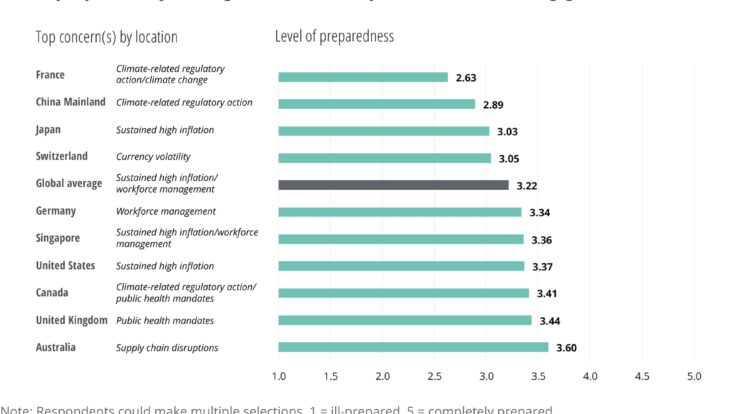

4. Global Economic Factors: The global economy will play a crucial role in shaping the real estate market. Factors such as interest rates, inflation, and economic growth will impact demand for housing, investment, and overall market stability.

5. Government Policies and Regulations: Government policies, such as tax incentives for homeownership, zoning regulations, and infrastructure development, can significantly impact the real estate market. Understanding these policies is essential for investors and buyers to navigate the market effectively.

Potential Challenges and Risks

1. Rising Interest Rates: Higher interest rates can increase the cost of borrowing, making mortgages more expensive and potentially slowing down demand for housing. This can lead to a decrease in property values and a slowdown in market growth.

2. Inflation and Cost of Living: Inflation can erode purchasing power and make it more challenging for individuals to afford housing. Rising costs of construction materials and labor can also lead to higher property prices, further impacting affordability.

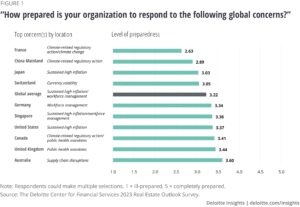

3. Economic Uncertainty: Global economic instability, such as recessions or trade wars, can impact investor confidence and lead to market volatility.

4. Supply Chain Disruptions: Ongoing supply chain disruptions can impact the availability of construction materials and labor, leading to delays in development projects and higher costs.

5. Climate Change and Natural Disasters: Climate change and increased frequency of natural disasters can impact property values and increase insurance premiums, particularly in vulnerable areas.

Strategic Opportunities for Investors and Buyers

1. Focus on Emerging Markets: As urbanization continues, investing in emerging markets with high growth potential can offer attractive returns. These markets often have lower entry barriers and a higher potential for capital appreciation.

2. Invest in Sustainable and Green Properties: The growing demand for sustainable and environmentally friendly properties presents a significant opportunity for investors. These properties tend to have higher resale values and attract environmentally conscious buyers.

3. Diversify Investment Portfolio: Diversifying investments across different asset classes, geographies, and property types can mitigate risk and enhance returns.

4. Leverage Technology: Utilize online platforms, data analytics, and virtual reality tours to make informed decisions and gain a competitive edge in the market.

5. Seek Professional Guidance: Consulting with real estate professionals, such as brokers, agents, and financial advisors, can provide valuable insights and guidance for navigating the complex real estate market.

Analyzing Key Market Segments

1. Residential Real Estate: The residential sector is expected to remain a key driver of growth in the coming years. Factors such as population growth, urbanization, and increasing demand for single-family homes and apartments will continue to fuel this segment.

2. Commercial Real Estate: The commercial real estate sector is expected to experience growth driven by factors such as economic expansion, technological advancements, and the rise of e-commerce. Office spaces, retail centers, and industrial warehouses are likely to see increased demand.

3. Industrial Real Estate: The industrial sector is expected to benefit from the growth of e-commerce and manufacturing. Demand for warehouses, logistics centers, and manufacturing facilities is likely to increase.

4. Hospitality and Tourism: The hospitality and tourism sector is expected to recover from the pandemic-induced slowdown, driven by pent-up demand for travel and leisure. Hotels, resorts, and vacation rentals are likely to experience a resurgence in demand.

5. Healthcare Real Estate: The healthcare sector is expected to continue growing due to factors such as an aging population and rising healthcare costs. Hospitals, clinics, and assisted living facilities are likely to see increased demand.

Regional Trends and Considerations

1. North America: The North American real estate market is expected to continue growing, driven by strong economic fundamentals, increasing urbanization, and low interest rates. Major cities, such as New York, Los Angeles, and Toronto, are expected to remain attractive investment destinations.

2. Europe: The European real estate market is expected to experience moderate growth, driven by factors such as low interest rates, increasing urbanization, and a growing demand for rental properties. Germany, France, and Spain are expected to remain key investment destinations.

3. Asia: The Asian real estate market is expected to experience significant growth, driven by factors such as rapid economic expansion, urbanization, and a rising middle class. China, India, and Southeast Asia are expected to be major growth drivers.

4. Latin America: The Latin American real estate market is expected to experience growth, driven by factors such as economic expansion, urbanization, and increasing tourism. Mexico, Brazil, and Colombia are expected to be key investment destinations.

5. Africa: The African real estate market is expected to experience rapid growth, driven by factors such as population growth, urbanization, and increasing economic activity. South Africa, Nigeria, and Kenya are expected to be key investment destinations.

Conclusion

The real estate market is constantly evolving, and understanding its dynamics is crucial for making informed investment decisions. This 5-year outlook provides a comprehensive overview of the key drivers, potential challenges, and strategic opportunities for investors and buyers. By leveraging this analysis, individuals can navigate the complex market with confidence and capitalize on the potential for growth and profitability.

Remember, a successful real estate strategy requires a thorough understanding of the market, careful consideration of risk, and a commitment to continuous learning and adaptation. With a proactive approach and a well-informed perspective, the future of real estate can be a powerful and rewarding journey.

Closure

Thus, we hope this article has provided valuable insights into The Booming 5-Year Outlook: A Powerful Real Estate Market Analysis. We appreciate your attention to our article. See you in our next article!

Sponsored Website: paid4link.com