Unlocking the 5 Pillars of Unstoppable Forex Trading Psychology

Related Articles: Unlocking the 5 Pillars of Unstoppable Forex Trading Psychology

- 5 Unstoppable Forex Brokers: Dominate The Markets With Confidence

- 5 Crucial Steps To Master The Exciting World Of Forex Trading

- Benefit With Forex

- Unleash The Power Of 100%: The Ultimate Guide To Automated Forex Trading

- Unleash Your Trading Potential: 5 Powerful Forex Signals To Dominate The Market

Introduction

With great pleasure, we will explore the intriguing topic related to Unlocking the 5 Pillars of Unstoppable Forex Trading Psychology. Let’s weave interesting information and offer fresh perspectives to the readers.

Unlocking the 5 Pillars of Unstoppable Forex Trading Psychology

The allure of Forex trading is undeniable: the potential for substantial profits, the ability to trade from anywhere in the world, and the constant challenge of navigating a dynamic market. But beneath the surface of this exciting opportunity lies a complex reality – the often overlooked, yet crucial aspect of Forex trading psychology.

While technical analysis and fundamental knowledge are vital, without a robust psychological foundation, even the most seasoned trader can fall prey to emotional pitfalls that undermine their trading success. This article dives deep into the 5 pillars of a strong Forex trading psychology, empowering you to develop the mental fortitude necessary to navigate the unpredictable world of Forex.

1. Embrace the Power of Self-Awareness:

The first step towards mastering your trading psychology is to confront your own biases and emotional triggers. We all have innate tendencies that can influence our trading decisions, sometimes leading us astray. For example, do you find yourself holding onto losing trades, hoping for a rebound, or cutting profits too early due to fear of losing what you’ve gained?

Identifying these biases is crucial.

- Journaling: Keep a detailed record of your trades, noting the reasons behind your decisions, the emotions you experienced, and the outcomes. This provides valuable insight into your patterns and helps you identify areas for improvement.

- Trading Simulation: Engage in risk-free practice with demo accounts. This allows you to experiment with different trading strategies without risking real capital, helping you understand your emotional responses in various market conditions.

- Feedback from Mentors: Seek guidance from experienced traders or coaches who can provide an objective perspective on your trading habits and offer constructive feedback.

2. Harness the Discipline of Risk Management:

In the volatile world of Forex, risk management isn’t just a strategy; it’s a psychological armor. It’s about protecting your capital and ensuring that even in the face of losses, you can continue trading without jeopardizing your financial well-being.

- Define Your Risk Tolerance: Before you enter the market, establish a clear understanding of how much risk you’re comfortable taking. This involves setting a stop-loss order for each trade, a pre-determined price point at which you exit a position to limit potential losses.

- Develop a Trading Plan: A well-defined plan outlines your entry and exit points, risk management strategies, and position sizing. Stick to your plan and avoid impulsive decisions driven by emotions.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your trades across different currency pairs and asset classes to mitigate risk and improve your overall portfolio performance.

3. Cultivate Emotional Resilience:

Forex trading is a rollercoaster ride of emotions. You’ll experience highs and lows, wins and losses. It’s essential to cultivate emotional resilience to navigate these fluctuations without letting them derail your trading strategy.

- Embrace Losses as Learning Opportunities: Losses are inevitable in trading. Instead of dwelling on them, analyze them objectively to identify the reasons behind them and learn from your mistakes.

- Celebrate Your Wins, But Don’t Get Carried Away: Celebrate your successes, but don’t let them inflate your ego. Stay grounded and maintain a balanced perspective.

- Practice Mindfulness: Techniques like meditation or deep breathing exercises can help you remain calm and focused even during periods of market volatility.

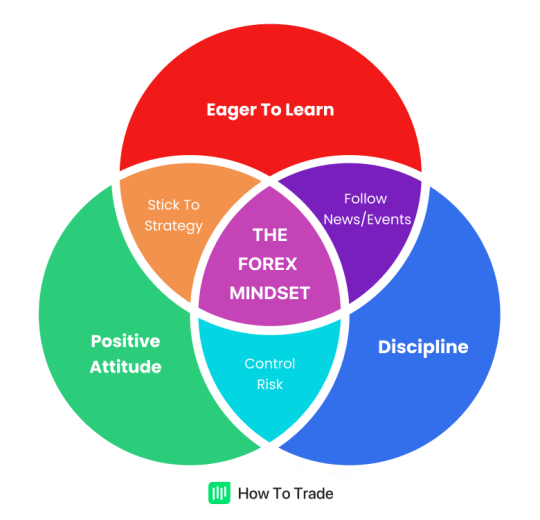

4. Develop a Strong Trading Mindset:

A winning trading mindset is characterized by patience, discipline, and a focus on long-term goals. It’s about approaching trading as a business, not a get-rich-quick scheme.

- Be Patient: Don’t chase quick profits or overtrade. Wait for the right opportunities and avoid impulsive decisions.

- Focus on the Process, Not Just the Outcome: Focus on executing your trading plan effectively, regardless of the immediate result.

- Set Realistic Expectations: Understand that Forex trading is a long-term game. Don’t expect to become a millionaire overnight.

5. Embrace Continuous Learning and Adaptability:

The Forex market is constantly evolving. To stay ahead of the curve, you need to be a lifelong learner, constantly expanding your knowledge and adapting to changing market dynamics.

- Stay Informed: Keep abreast of global economic events, market trends, and new trading strategies through reputable sources like financial news websites, trading blogs, and educational resources.

- Refine Your Trading Strategy: Continuously evaluate your trading methods and make adjustments based on your experience, market conditions, and new insights.

- Seek Feedback and Mentorship: Don’t be afraid to ask for help from experienced traders or coaches. They can provide valuable guidance and support as you navigate the complexities of the market.

Overcoming the Psychological Barriers:

The journey to mastering Forex trading psychology is ongoing. It’s about developing a deep understanding of yourself, your emotional triggers, and the market dynamics. By embracing the 5 pillars outlined above, you can cultivate a strong foundation for success in the world of Forex.

Remember, it’s not just about making money; it’s about building a sustainable trading approach that empowers you to achieve your financial goals while navigating the emotional rollercoaster of the market.

Key Takeaways:

- Forex trading psychology is crucial for success, as it helps traders overcome emotional biases and make rational decisions.

- Self-awareness, risk management, emotional resilience, a strong trading mindset, and continuous learning are essential pillars of a robust Forex trading psychology.

- Building a strong psychological foundation requires ongoing effort and self-reflection.

- By embracing these principles, traders can enhance their trading performance and achieve greater success in the Forex market.

Final Thoughts:

While the allure of quick profits may tempt you to rush into trading, remember that true success lies in cultivating a strong trading psychology. Invest in your mental game, and you’ll be well on your way to unlocking the potential of the Forex market.

Closure

Thus, we hope this article has provided valuable insights into Unlocking the 5 Pillars of Unstoppable Forex Trading Psychology. We hope you find this article informative and beneficial. See you in our next article!

Sponsored Website: paid4link.com