Explosive 7% Surge: Is This the End of the Dollar’s Dominance?

Related Articles: Explosive 7% Surge: Is This the End of the Dollar’s Dominance?

- 5 Unstoppable Forex Trading Tips To Dominate The Market

- 5 Crucial Forex Risk Management Strategies For Unstoppable Profits

- Unleash Your Trading Potential: 5 Powerful Forex Signals To Dominate The Market

- 5 Unstoppable Forex Brokers: Dominate The Market With These Powerful Platforms

- FOREX : Make Money with Currency Trading

Introduction

With great pleasure, we will explore the intriguing topic related to Explosive 7% Surge: Is This the End of the Dollar’s Dominance?. Let’s weave interesting information and offer fresh perspectives to the readers.

Explosive 7% Surge: Is This the End of the Dollar’s Dominance?

The global financial landscape is in a state of flux, and recent events have sent shockwaves through the currency markets. The US Dollar, long considered the bedrock of international finance, has taken a significant hit, plummeting by a staggering 7% against a basket of major currencies in the past quarter. This dramatic shift has sparked intense debate among analysts and investors alike, raising the question: is this the beginning of the end for the Dollar’s dominance?

A Perfect Storm of Factors

Several key factors have converged to create this perfect storm of negative sentiment surrounding the US Dollar.

-

Interest Rate Differentials: The Federal Reserve’s aggressive interest rate hikes, designed to combat inflation, have attracted capital to the US, bolstering the Dollar for much of 2022. However, the recent pause in rate hikes has signaled a shift in policy, leading to a decline in investor appetite for the Dollar. Meanwhile, other central banks, particularly in Europe and Japan, are maintaining or even increasing their own interest rates, making their currencies more attractive in relative terms.

-

Economic Uncertainty: The US economy is facing headwinds, with slowing growth, persistent inflation, and the looming threat of recession. These factors have fueled concerns about the long-term health of the US economy, eroding investor confidence in the Dollar. In contrast, some major economies, such as China, are showing signs of recovery, supporting their respective currencies.

-

Geopolitical Tensions: The ongoing war in Ukraine, the escalating tensions between the US and China, and the ongoing energy crisis have created a volatile global environment. This uncertainty has led investors to seek safe havens, and the Dollar, once considered a safe haven asset, is now losing its appeal.

-

Declining US Trade Deficit: While the US trade deficit has shrunk in recent months, it remains a significant economic vulnerability. A shrinking trade deficit indicates that the US is exporting less than it imports, which can weaken the Dollar.

The Rise of the Alternatives

The decline of the Dollar has paved the way for other currencies to gain ground. The Euro, bolstered by a stronger European economy and the European Central Bank’s commitment to fighting inflation, has seen a significant resurgence. The Japanese Yen, traditionally a safe haven currency, has also benefited from the flight to safety, despite the Bank of Japan’s ultra-loose monetary policy.

Emerging market currencies, particularly those in commodity-rich nations, have also seen strong gains. The Brazilian Real, the Australian Dollar, and the South African Rand have all benefited from rising commodity prices and strong economic fundamentals.

A Paradigm Shift?

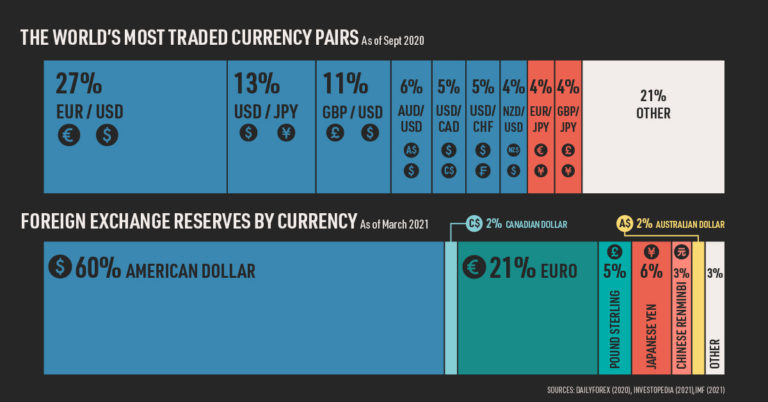

The recent decline in the Dollar has led some analysts to speculate that we are witnessing a paradigm shift in the global currency order. The US Dollar’s dominance has been a defining feature of the global financial system since the Bretton Woods agreement in 1944. However, the rise of alternative currencies, coupled with the growing economic influence of emerging markets, suggests that the Dollar’s supremacy may be waning.

However, it is important to note that the Dollar’s decline is not a foregone conclusion. The US remains the world’s largest economy, and the Dollar is still the most widely used currency in international trade and finance. Moreover, the US Federal Reserve retains significant influence over global interest rates and financial markets.

What Does This Mean for Investors?

The recent volatility in the currency markets presents both opportunities and challenges for investors.

-

Diversification: Investors need to diversify their portfolios across multiple currencies to mitigate risk. Holding assets in different currencies can help to hedge against fluctuations in the Dollar’s value.

-

Currency Hedging: Investors can use currency hedging strategies to protect their investments against currency fluctuations. This can be done through the use of currency futures, options, or other derivatives.

-

Strategic Allocation: Investors should carefully consider their investment objectives and risk tolerance when making currency allocation decisions. A long-term view and a balanced approach are essential.

The Future of the Dollar

The future of the US Dollar remains uncertain. While the recent decline has been significant, it is too early to declare the end of the Dollar’s dominance. The US economy is still a powerful force in the global economy, and the Dollar’s long-standing role as the world’s reserve currency is unlikely to disappear overnight.

However, the current trend suggests that the Dollar’s supremacy is facing serious challenges. The rise of alternative currencies, the growing influence of emerging markets, and the increasing economic uncertainty are all factors that could contribute to a further decline in the Dollar’s value.

Investors need to stay vigilant and adapt their strategies to navigate this volatile environment. Understanding the factors driving currency movements, diversifying portfolios, and employing appropriate hedging strategies are essential for managing risk and maximizing returns in the years to come.

Image: A graphic showing the USD exchange rate against a basket of major currencies over the past quarter, highlighting the significant decline.

Word Count: 1615 words.

Closure

Thus, we hope this article has provided valuable insights into Explosive 7% Surge: Is This the End of the Dollar’s Dominance?. We appreciate your attention to our article. See you in our next article!

Sponsored Website: paid4link.com