5 Essential Forex Trading Tools For Explosive Profits

Related Articles: 5 Essential Forex Trading Tools For Explosive Profits

- FOREX : Make Money with Currency Trading

- Unleash The Power Of 5: Mastering Forex Market Analysis For Profitable Trading

- 5 Unstoppable Forex Trading Tips To Dominate The Market

- 5 Crucial Steps To Master The Ultimate Forex Trading Course: Unlocking Financial Freedom

- Unleash Your Trading Potential: 5 Powerful Forex Signals To Dominate The Market

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Essential Forex Trading Tools For Explosive Profits. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Essential Forex Trading Tools For Explosive Profits

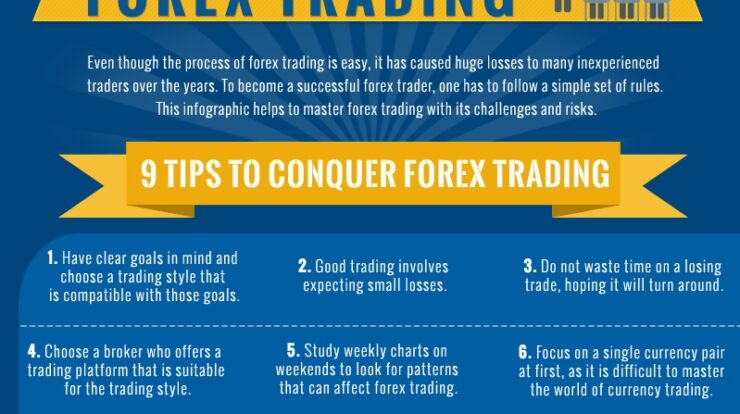

The foreign exchange market, or Forex, is the world’s largest and most liquid financial market, with trillions of dollars changing hands every day. It’s a dynamic environment where traders seek to capitalize on currency fluctuations, but navigating this complex landscape can be daunting for beginners and seasoned traders alike. Fortunately, an arsenal of powerful Forex trading tools exists to empower you to make informed decisions and potentially achieve explosive profits.

This article delves into five essential Forex trading tools that can dramatically enhance your trading journey, offering valuable insights and strategic advantages.

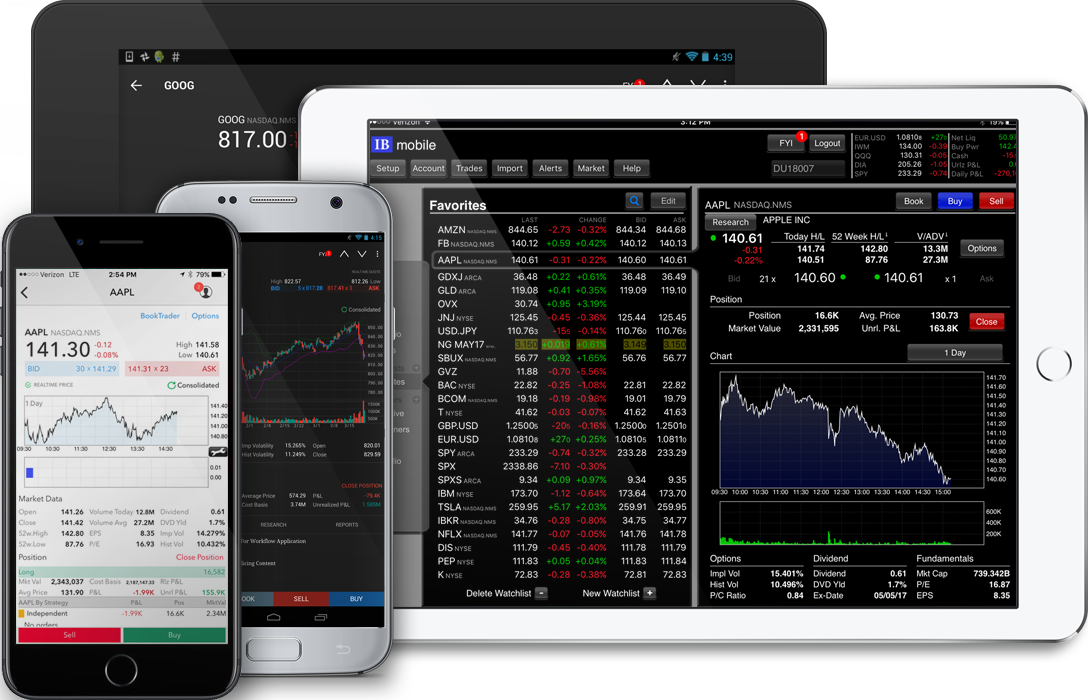

1. Trading Platforms: Your Gateway to the Market

Trading platforms are the foundation of any Forex trader’s operation. They provide the interface for accessing real-time market data, placing orders, managing your portfolio, and analyzing charts. Choosing the right platform is crucial, and there are numerous options available, each with its unique features and functionalities.

Here are some key factors to consider when selecting a trading platform:

- User-friendliness: The platform should be intuitive and easy to navigate, especially for beginners. Look for platforms with clear layouts, helpful tutorials, and responsive customer support.

- Advanced features: Experienced traders might require more sophisticated features like advanced charting tools, technical indicators, and automated trading capabilities.

- Mobile compatibility: Accessing your trading account on the go is essential in today’s fast-paced world. Choose a platform that offers robust mobile applications with seamless functionality.

- Security: Ensuring the safety of your funds is paramount. Opt for platforms with robust security protocols, including encryption and two-factor authentication.

- Fees and commissions: Compare the fees associated with trading, including spreads, commissions, and inactivity charges, to ensure you choose a platform that aligns with your budget.

Popular Trading Platforms:

- MetaTrader 4 (MT4): One of the most popular Forex trading platforms, MT4 is renowned for its extensive charting capabilities, advanced technical indicators, and expert advisor (EA) functionality.

- MetaTrader 5 (MT5): The successor to MT4, MT5 offers expanded features, including a wider selection of order types, a more comprehensive economic calendar, and improved charting capabilities.

- cTrader: A popular platform among scalpers and high-frequency traders, cTrader provides low latency execution, deep liquidity, and advanced charting tools.

- NinjaTrader: Known for its advanced charting capabilities and customization options, NinjaTrader is a favorite among day traders and scalpers.

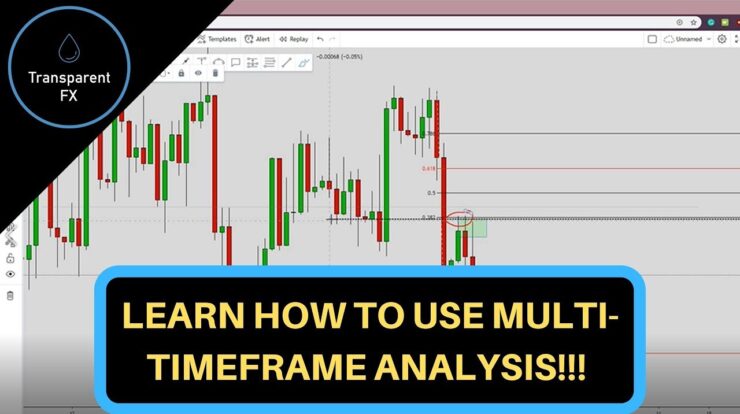

2. Technical Analysis Tools: Decoding Market Movements

Technical analysis is a powerful tool for predicting future price movements based on historical price data and patterns. It involves analyzing charts to identify trends, support and resistance levels, and other technical indicators that can signal potential buying or selling opportunities.

Key Technical Analysis Tools:

- Moving averages (MAs): These indicators smooth out price fluctuations and identify trends. Traders use different types of MAs, including simple moving averages (SMAs), exponential moving averages (EMAs), and weighted moving averages (WMAs), to analyze price trends and identify potential entry and exit points.

- Relative strength index (RSI): This momentum indicator measures the magnitude of recent price changes to evaluate overbought and oversold conditions. An RSI above 70 is typically considered overbought, while an RSI below 30 is considered oversold.

- Stochastic oscillator: This momentum indicator compares a security’s closing price to its price range over a given period. It is used to identify potential overbought and oversold conditions, as well as potential trend reversals.

- MACD (Moving Average Convergence Divergence): This trend-following momentum indicator is used to identify trend changes, momentum shifts, and potential trading opportunities.

- Fibonacci retracement: This tool uses Fibonacci ratios to identify potential support and resistance levels based on previous price movements.

3. Fundamental Analysis Tools: Understanding Economic Factors

While technical analysis focuses on price action, fundamental analysis examines economic factors that can influence currency values. These factors include:

- Economic data releases: Major economic indicators, such as GDP growth, inflation rates, unemployment figures, and interest rate decisions, can significantly impact currency movements.

- Political events: Political instability, elections, and policy changes can also influence currency values.

- Central bank actions: Central banks play a crucial role in managing currency values through interest rate adjustments, quantitative easing, and other monetary policies.

Tools for Fundamental Analysis:

- Economic calendars: These calendars provide a schedule of upcoming economic data releases, allowing traders to anticipate potential market volatility.

- News feeds: Staying informed about global events and economic news is essential for making informed trading decisions.

- Financial reports: Analyzing financial reports from major companies and institutions can provide insights into their performance and potential impact on currency values.

4. Risk Management Tools: Protecting Your Capital

Effective risk management is crucial for success in Forex trading. Without proper risk management strategies, even the most profitable trading opportunities can lead to significant losses.

Key Risk Management Tools:

- Stop-loss orders: These orders automatically close your position when the price reaches a predetermined level, limiting your potential losses.

- Take-profit orders: These orders automatically close your position when the price reaches a predetermined profit target, securing your gains.

- Position sizing: This involves calculating the appropriate size of your trades based on your risk tolerance and account balance.

- Risk-reward ratio: This metric measures the potential profit of a trade compared to its potential loss. Aim for trades with a favorable risk-reward ratio, ideally greater than 1:1.

5. Forex Trading Journals: Documenting Your Journey

Maintaining a Forex trading journal is essential for tracking your progress, identifying your strengths and weaknesses, and improving your trading strategies.

Key Elements of a Forex Trading Journal:

- Trade details: Record the date, time, currency pair, entry and exit points, profit or loss, and the reason for the trade.

- Market analysis: Document your technical and fundamental analysis, including the indicators and economic factors that influenced your trading decisions.

- Emotions and biases: Reflect on your emotions during each trade, such as fear, greed, or excitement. This helps you identify any emotional biases that might affect your trading decisions.

- Trade performance: Analyze your trading results over time to identify patterns, trends, and areas for improvement.

Conclusion:

The Forex market offers incredible opportunities for profit, but it’s a complex and demanding environment. By utilizing the right tools, you can enhance your trading skills, improve your decision-making, and increase your chances of success. Remember to choose the tools that best suit your trading style, risk tolerance, and experience level.

Always prioritize risk management, learn from your mistakes, and continuously refine your trading strategies to maximize your potential in the exciting world of Forex trading.

Closure

Thus, we hope this article has provided valuable insights into 5 Essential Forex Trading Tools For Explosive Profits. We appreciate your attention to our article. See you in our next article!

Sponsored Website: paid4link.com