5 Powerful Forex Trading Strategies for Explosive Profits

Related Articles: 5 Powerful Forex Trading Strategies for Explosive Profits

Introduction

With great pleasure, we will explore the intriguing topic related to 5 Powerful Forex Trading Strategies for Explosive Profits. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Powerful Forex Trading Strategies for Explosive Profits

The foreign exchange market, or Forex, is the largest and most liquid financial market in the world. With trillions of dollars changing hands every day, it presents an alluring opportunity for traders seeking to profit from currency fluctuations. However, the Forex market is also notoriously volatile and complex, making it essential to employ effective trading strategies to navigate its intricacies and achieve success. This article delves into five powerful Forex trading strategies that can help you maximize your potential for explosive profits.

1. Trend Trading: Riding the Waves of Momentum

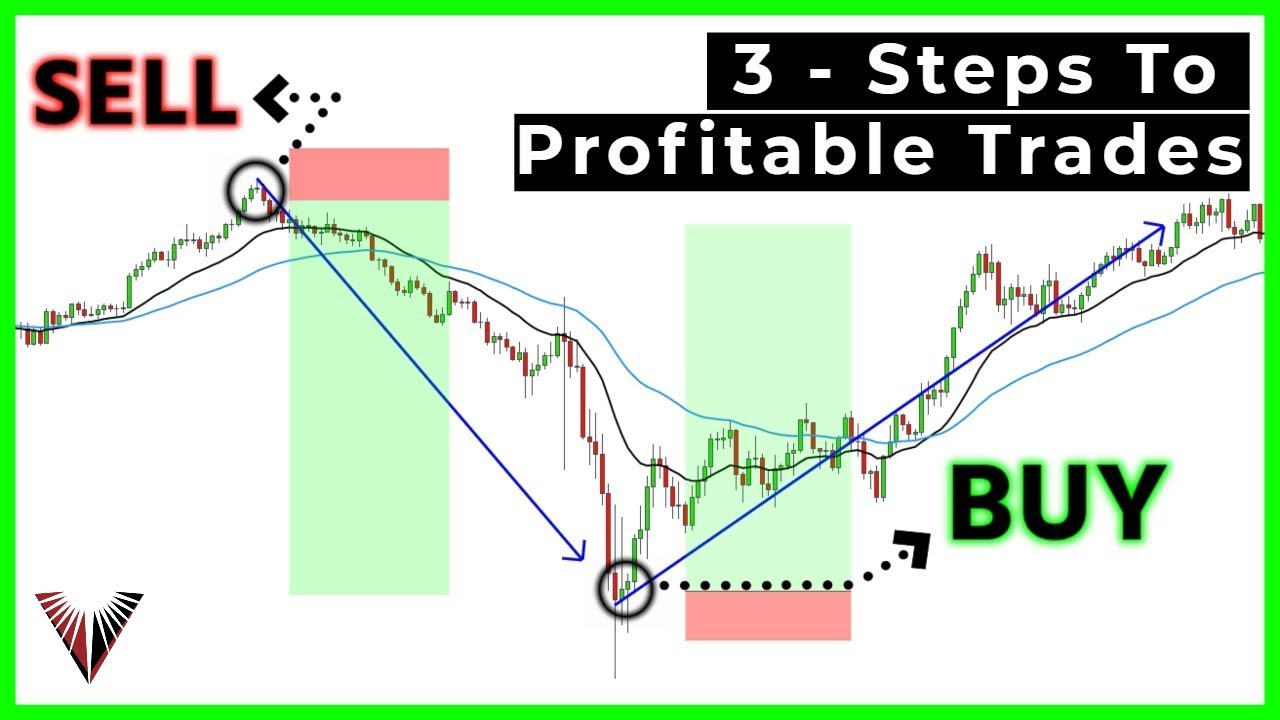

Trend trading is a fundamental strategy that involves identifying and capitalizing on established trends in currency pairs. This approach focuses on analyzing price action and using technical indicators to pinpoint the direction of a trend, whether it’s bullish (upward) or bearish (downward).

- Identifying Trends: Recognizing a trend requires analyzing price charts for consistent movement in a particular direction. This can be achieved by using candlestick patterns, moving averages, and trend lines.

- Confirming Trends: Once a potential trend is identified, it’s crucial to confirm its validity using technical indicators. Indicators like the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) can help gauge the strength and longevity of the trend.

- Entry and Exit Points: Trend traders aim to enter trades when the trend is strong and exit when the trend weakens or reverses. They utilize support and resistance levels, breakout points, and retracement patterns to determine optimal entry and exit points.

2. Scalping: Short-Term Gains, Frequent Trades

Scalping is a high-frequency trading strategy that aims to capitalize on small price fluctuations within a short timeframe. Scalpers typically hold positions for seconds or minutes, seeking to profit from minor market movements.

- Fast Execution: Scalping requires lightning-fast execution to capitalize on fleeting opportunities. This often involves using automated trading platforms and algorithms.

- Technical Indicators: Scalpers rely heavily on technical indicators to identify entry and exit points. Indicators like moving averages, stochastic oscillators, and Bollinger Bands provide signals for short-term price movements.

- Risk Management: Due to the high volume of trades, scalpers must implement strict risk management strategies to mitigate potential losses. Stop-loss orders and position sizing are essential components of successful scalping.

3. News Trading: Riding the Waves of Market Sentiment

News trading involves capitalizing on market reactions to significant economic news releases and events. These events can cause substantial price fluctuations in currency pairs, offering opportunities for traders to profit from the volatility.

- Economic Calendar: Traders must closely monitor economic calendars for upcoming news releases and events that could impact currency markets.

- Market Sentiment: News trading requires understanding how specific news events will affect market sentiment. Positive news releases can boost a currency’s value, while negative news can weaken it.

- Timing is Key: The key to successful news trading is timing. Traders need to anticipate market reactions and enter trades before the news is released, or immediately after, when the market is most volatile.

4. Range Trading: Confining Price Fluctuations

Range trading focuses on identifying and exploiting price movements within a defined range. This strategy assumes that a currency pair will fluctuate between specific support and resistance levels, offering opportunities for both long and short positions.

- Support and Resistance: Range traders identify clear support and resistance levels on price charts. These levels represent areas where the price has historically bounced back from, indicating potential turning points.

- Breakout and Breakdown: Traders can also capitalize on breakouts and breakdowns of the range. A breakout occurs when the price moves above the resistance level, while a breakdown occurs when it falls below the support level.

- Channel Trading: Channel trading is a variation of range trading that involves identifying trend lines within the range. Traders aim to enter trades when the price bounces off these trend lines, expecting it to return to the center of the channel.

5. Arbitrage Trading: Capitalizing on Price Discrepancies

Arbitrage trading involves exploiting price differences between different markets for the same currency pair. This strategy takes advantage of temporary discrepancies in pricing, allowing traders to buy low in one market and sell high in another.

- Market Efficiency: Arbitrage opportunities are typically short-lived and require lightning-fast execution. Efficient markets tend to eliminate price discrepancies quickly.

- Real-Time Monitoring: Arbitrage traders rely on real-time market data and sophisticated trading platforms to identify and exploit price differences.

- Scalability: Arbitrage trading can be highly scalable, allowing traders to capitalize on multiple price discrepancies simultaneously.

Understanding the Risks

While Forex trading offers potential for substantial profits, it’s essential to understand the inherent risks involved. Here are some key considerations:

- Market Volatility: The Forex market is highly volatile, making price movements unpredictable. This can lead to rapid losses if trades are not managed effectively.

- Leverage: Leverage can amplify both profits and losses. While it allows traders to control larger positions with smaller capital, it also increases risk exposure.

- Economic and Geopolitical Events: Economic and geopolitical events can significantly impact currency markets. Unforeseen events can lead to sudden and drastic price fluctuations.

Conclusion

Mastering Forex trading strategies is crucial for navigating the complexities and volatility of the foreign exchange market. By employing the five powerful strategies outlined in this article, traders can enhance their ability to identify profitable opportunities and maximize their potential for explosive profits. However, it’s essential to approach Forex trading with a disciplined mindset, a thorough understanding of the risks involved, and a comprehensive risk management plan. Remember, success in Forex trading requires continuous learning, adaptation, and a commitment to developing a strong trading edge.

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Forex Trading Strategies for Explosive Profits. We thank you for taking the time to read this article. See you in our next article!

Sponsored Website: paid4link.com