5 Powerful Reasons Why Business Credit Cards Are Your Ultimate Weapon

Related Articles: 5 Powerful Reasons Why Business Credit Cards Are Your Ultimate Weapon

- 5 Essential Tips For Navigating The Dangerous World Of Student Credit Cards

- 5 Powerful Strategies For Ultimate Credit Card Fraud Protection

- 5 Game-Changing Reasons Why Business Credit Cards Are A Revolution For Your Company

- 5 Crucial Steps To Unlocking Your Financial Freedom With A Bad Credit Card

- The Ultimate Guide To 10x Your Rewards: Credit Card Points And Cashback Explained

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 5 Powerful Reasons Why Business Credit Cards Are Your Ultimate Weapon. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Powerful Reasons Why Business Credit Cards Are Your Ultimate Weapon

The world of business is a competitive arena, demanding strategic thinking and smart financial management. While traditional business loans might seem like the go-to option for funding, they often come with stringent requirements and lengthy approval processes. This is where the power of business credit cards steps in, offering a surprisingly effective and flexible alternative.

What are Business Credit Cards?

Business credit cards are designed specifically for businesses, allowing them to make purchases and manage expenses in a more streamlined and convenient way. They are distinct from personal credit cards and offer unique benefits tailored to the needs of companies, large or small.

Why are Business Credit Cards so Powerful?

Here are five compelling reasons why business credit cards are an indispensable tool for your company’s success:

1. Building Business Credit:

Building a strong business credit score is crucial for securing loans, obtaining better interest rates, and establishing credibility in the market. Business credit cards are instrumental in this process. By making timely payments and utilizing the card responsibly, you actively build your business credit history, which translates into better financial opportunities down the line.

2. Cash Flow Management:

Business credit cards can be a lifeline for managing cash flow. By using them for operational expenses like supplies, travel, and marketing, you can free up working capital and avoid tying up cash in inventory or accounts receivable. This flexibility allows you to allocate funds more strategically and maintain a healthy cash flow, which is vital for business growth.

3. Access to Rewards and Perks:

Many business credit cards offer lucrative rewards programs, including cash back, travel points, and discounts on business-related expenses. These perks can add significant value to your bottom line, providing tangible benefits that offset the cost of using the card.

4. Enhanced Purchase Protection and Fraud Coverage:

Business credit cards often come with robust purchase protection and fraud coverage. This provides a safety net for your business, protecting you from unexpected losses due to damaged or defective goods or fraudulent transactions. These benefits can be invaluable in mitigating financial risks and safeguarding your business assets.

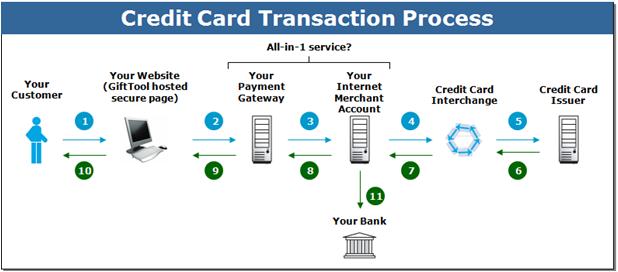

5. Convenient and Secure Payment Options:

Business credit cards provide a convenient and secure way to make payments online, over the phone, and in person. They eliminate the hassle of carrying large amounts of cash and offer greater control over spending through detailed transaction statements and online account management tools.

Choosing the Right Business Credit Card:

With a multitude of business credit card options available, choosing the right one is crucial. Consider these factors when making your decision:

- Annual Fee: Look for cards with reasonable annual fees or no annual fees at all.

- Interest Rates: Compare interest rates and choose a card with a competitive rate, especially if you anticipate carrying a balance.

- Rewards Programs: Evaluate the rewards structure and select a card that aligns with your business’s spending habits and needs.

- Credit Limit: Choose a card with a credit limit that accommodates your business’s spending needs without jeopardizing your credit utilization ratio.

- Additional Features: Explore additional benefits like travel insurance, extended warranties, and other perks that can enhance your business operations.

Responsible Use is Key:

While business credit cards offer numerous benefits, it’s essential to use them responsibly. Avoid carrying a balance for extended periods, as this can lead to accumulating high interest charges. Always make timely payments and track your spending diligently to ensure that you stay within your budget and maintain a healthy credit utilization ratio.

The Advantages Outweigh the Risks:

When used wisely, business credit cards can be a potent tool for driving business growth and maximizing financial efficiency. They offer a flexible and convenient way to manage expenses, build business credit, and access valuable rewards. By understanding the benefits and practicing responsible use, you can unlock the power of business credit cards and propel your company towards success.

Beyond the Basics: Exploring Advanced Business Credit Card Features

While the fundamental advantages of business credit cards are undeniable, there are also advanced features that can further elevate their impact on your business.

1. Employee Cards: Many business credit cards offer the option of issuing employee cards with controlled spending limits. This allows you to delegate purchasing power while maintaining oversight and tracking expenses effectively. Employee cards can simplify expense management, streamline procurement processes, and improve employee accountability.

2. Travel Benefits: Some business credit cards provide exclusive travel benefits, including airport lounge access, travel insurance, and bonus miles or points. These perks can significantly enhance your business travel experience, making it more efficient and enjoyable.

3. Merchant Services Integration: Certain business credit cards offer integrated merchant services solutions, allowing you to accept credit card payments from customers directly. This can be a valuable feature for businesses with a physical presence, simplifying transaction processing and increasing convenience for customers.

4. Business Consulting Services: Some issuers provide access to business consulting services, offering guidance on financial management, marketing strategies, and other aspects of business development. This specialized support can be invaluable for entrepreneurs and growing businesses.

5. Mobile App Integration: Modern business credit cards often come with user-friendly mobile app integration. These apps allow you to track spending, monitor account activity, make payments, and access various card features directly from your smartphone. This accessibility enhances convenience and allows you to manage your business finances on the go.

Navigating the Evolving Business Credit Card Landscape:

The business credit card landscape is constantly evolving, with new products and features emerging regularly. Stay informed about the latest offerings and compare different options to find the best fit for your business needs.

Conclusion: Empowering Your Business with the Right Tools:

Business credit cards are powerful tools that can significantly enhance your financial capabilities. By understanding their benefits, choosing the right card, and utilizing them responsibly, you can unlock a world of opportunities for your business, fostering growth, efficiency, and financial stability. Remember, building a strong business credit score is an investment in your company’s future, paving the way for access to funding, partnerships, and ultimately, sustained success.

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Reasons Why Business Credit Cards Are Your Ultimate Weapon. We hope you find this article informative and beneficial. See you in our next article!

Sponsored Website: paid4link.com