The Ultimate Guide to 10x Your Rewards: Credit Card Points and Cashback Explained

Related Articles: The Ultimate Guide to 10x Your Rewards: Credit Card Points and Cashback Explained

- Unlocking Financial Freedom: 5 Essential Tips For Getting A Credit Card With Bad Credit

- Tricks of Credit Card Company

- Credit card Examinations – Picking The Best Arrangement

- 5 Unbelievable Credit Card Benefits That Can Transform Your Finances

- “Bad Credit” Credit Cards: How You Can Avoid High Fees

Introduction

With great pleasure, we will explore the intriguing topic related to The Ultimate Guide to 10x Your Rewards: Credit Card Points and Cashback Explained. Let’s weave interesting information and offer fresh perspectives to the readers.

The Ultimate Guide to 10x Your Rewards: Credit Card Points and Cashback Explained

The world of credit cards can be a confusing labyrinth, especially when it comes to points and cashback. But don’t worry, you’re not alone. Many people find themselves overwhelmed by the sheer number of options and the intricate details of earning and redeeming these valuable rewards. This guide will demystify the process, empowering you to maximize your earning potential and make the most of your credit card spending.

Understanding the Basics: Points vs. Cashback

At their core, both credit card points and cashback programs offer you a way to earn rewards for your everyday purchases. However, the way they work and the value you receive can vary significantly.

Cashback:

- Simple and straightforward: Cashback rewards are exactly what they sound like – you earn cash back on your purchases.

- Typically a fixed percentage: Most cashback cards offer a flat percentage back, ranging from 1% to 5%, on all purchases or specific categories like groceries or gas.

- Easy to redeem: Cashback rewards are usually automatically deposited into your account or can be redeemed for a statement credit, making them a convenient option.

Points:

- More flexibility: Points can be redeemed for a variety of rewards, including travel, merchandise, gift cards, and even cash back.

- Earning potential can be higher: Points programs often offer bonus categories for specific spending, allowing you to earn more points on purchases you make frequently.

- Potential for greater value: When redeemed strategically, points can often be worth more than their face value, especially for travel rewards.

Choosing the Right Program for You:

The best credit card rewards program for you depends on your spending habits and priorities. Here’s a breakdown of key factors to consider:

1. Spending Habits:

- Frequent traveler: If you travel frequently, a points program that offers travel rewards, such as airline miles or hotel points, could be the most beneficial.

- Everyday spender: For everyday purchases, a cashback card might be the simplest and most straightforward option.

- Targeted spender: If you tend to spend a lot on specific categories, such as groceries or dining, a card with bonus rewards in those areas could be a good fit.

2. Redemption Preferences:

- Cash is king: If you prefer the simplicity of cash back, a cashback card is a clear winner.

- Travel enthusiast: If you dream of luxury vacations or frequent business trips, a points program with strong travel redemption options could be your best bet.

- Merchandise and experiences: Some points programs allow you to redeem for merchandise, gift cards, or even experiences, offering a wider range of options.

3. Credit Score and Financial Responsibility:

- Credit score impact: Applying for and using credit cards can affect your credit score. Choose a card that aligns with your creditworthiness and financial goals.

- Responsible spending: Always use your credit card responsibly, paying your balance in full each month to avoid interest charges and maintain a healthy credit score.

Maximizing Your Rewards: Tips and Strategies

Once you’ve chosen a credit card program, here are some strategies to maximize your rewards:

1. Utilize Bonus Categories:

- Pay attention to bonus categories: Most credit cards offer bonus rewards for spending in certain categories, such as dining, travel, groceries, or gas.

- Strategize your spending: Make an effort to use your card for purchases that earn you bonus points or cashback.

- Track your spending: Keep track of your spending and ensure you’re maximizing your earning potential by using your card for qualifying purchases.

2. Take Advantage of Sign-Up Bonuses:

- Explore sign-up bonuses: Many credit cards offer lucrative sign-up bonuses, such as a certain number of points or a cashback amount after spending a specific amount within a set timeframe.

- Meet the minimum spending requirements: Read the terms and conditions carefully to ensure you understand the requirements for earning the bonus.

- Don’t be afraid to switch cards: If you find a card with a better sign-up bonus or more valuable rewards, consider transferring your balance to a new card.

3. Consider a Rewards Credit Card:

- Targeted rewards: Rewards credit cards are specifically designed to offer significant rewards in specific categories.

- High earning potential: These cards can help you earn more points or cashback on your everyday purchases.

- Potential for travel rewards: Many rewards credit cards offer generous travel benefits, including airline miles, hotel points, or travel insurance.

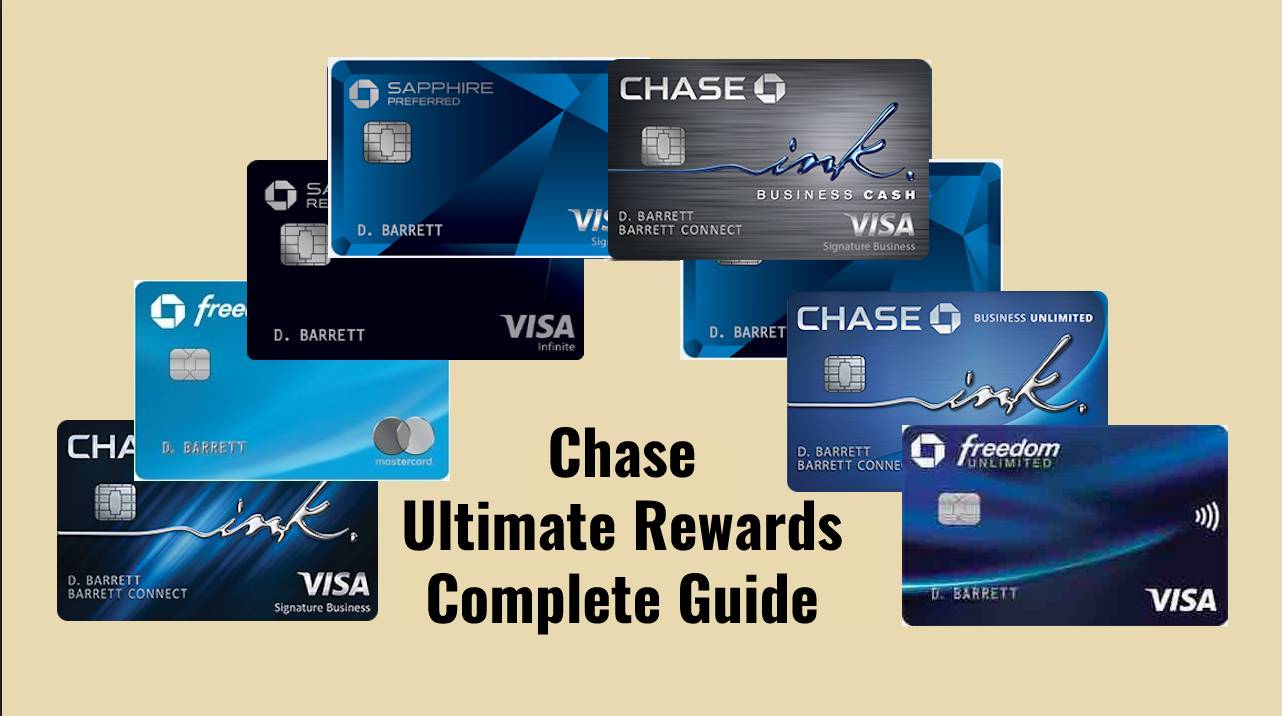

4. Don’t Forget About Transfer Bonuses:

- Transfer points to airline or hotel programs: Some credit cards allow you to transfer your points to partner airline or hotel loyalty programs.

- Maximize value: Transferring points can often offer more value than redeeming them for other rewards.

- Research transfer options: Check the terms and conditions to understand the transfer ratio and any associated fees.

5. Utilize Travel Portals:

- Redeem points for travel: Many credit card programs have their own travel portals where you can book flights, hotels, and other travel services.

- Potential for better deals: These portals often offer exclusive discounts and deals not available elsewhere.

- Compare prices: Always compare prices with other travel websites to ensure you’re getting the best value.

6. Utilize Credit Card Perks:

- Explore additional benefits: Many credit cards offer additional perks beyond rewards, such as travel insurance, purchase protection, or concierge services.

- Take advantage of valuable perks: Use these benefits to enhance your travel experience or protect your purchases.

7. Manage Your Credit Wisely:

- Avoid carrying a balance: Pay your balance in full each month to avoid interest charges and maximize your rewards.

- Monitor your spending: Keep track of your spending to avoid overspending and ensure you’re using your card responsibly.

The Importance of Responsible Credit Card Usage:

While credit card rewards can be a valuable benefit, it’s crucial to use credit cards responsibly. Remember:

- Avoid overspending: Only use your credit card for purchases you can afford to pay off in full each month.

- Pay on time: Late payments can negatively impact your credit score and lead to interest charges.

- Monitor your credit report: Regularly check your credit report to ensure accuracy and identify any potential issues.

Conclusion:

Understanding credit card points and cashback programs can be a powerful tool for maximizing your rewards and enhancing your financial well-being. By carefully choosing a program that aligns with your spending habits and priorities, utilizing strategic tips, and practicing responsible credit card usage, you can unlock the potential of these valuable benefits and reap the rewards of your everyday spending. Remember, the key is to make informed decisions, prioritize responsible spending, and leverage the power of credit card rewards to your advantage.

Closure

Thus, we hope this article has provided valuable insights into The Ultimate Guide to 10x Your Rewards: Credit Card Points and Cashback Explained. We thank you for taking the time to read this article. See you in our next article!

Sponsored Website: paid4link.com