5 Powerful Strategies for Ultimate Credit Card Fraud Protection

Related Articles: 5 Powerful Strategies for Ultimate Credit Card Fraud Protection

- The 5-Step Credit Card Application Process: A Comprehensive Guide To Financial Freedom

- 5 Powerful Strategies For Conquering Your Credit Card Debt

- “Bad Credit” Credit Cards: How You Can Avoid High Fees

- Tricks of Credit Card Company

- The 5 Crucial Differences Between Secured And Unsecured Credit Cards: Which Is Right For You?

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Powerful Strategies for Ultimate Credit Card Fraud Protection. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Powerful Strategies for Ultimate Credit Card Fraud Protection

Credit card fraud is a growing problem, with millions of people falling victim to this crime every year. The ease of online shopping and the increasing sophistication of fraudsters have made it more difficult than ever to protect your credit card information. However, there are steps you can take to significantly reduce your risk. This article will delve into 5 powerful strategies that can help you achieve ultimate credit card fraud protection.

Understanding the Threats

Before we dive into the strategies, it’s crucial to understand the different types of credit card fraud you might encounter. Here are a few common examples:

- Skimming: This involves using a device to steal credit card information when you swipe your card at a point-of-sale terminal.

- Phishing: Fraudsters send emails or text messages that appear to be from legitimate companies, tricking you into providing your credit card details.

- Card Not Present (CNP) Fraud: This occurs when a thief uses your credit card information to make purchases online or over the phone without having the physical card.

- Identity Theft: This involves stealing your personal information, including your credit card details, to open new accounts or make unauthorized purchases.

Strategy 1: Be Vigilant – The Power of Awareness

The first line of defense against credit card fraud is awareness. By understanding the common tactics fraudsters use and being vigilant in your daily transactions, you can significantly reduce your risk. Here are some key steps:

- Pay Attention to Your Surroundings: When using your credit card at a store or ATM, be aware of your surroundings. Look for signs of tampering with the card reader or any suspicious activity.

- Protect Your Card: Keep your credit card in a safe place, preferably a wallet or purse that you can keep close to you at all times.

- Be Wary of Phishing Attempts: Be cautious of any emails or text messages asking for your credit card information. Legitimate companies will never ask for this information through email or text.

- Monitor Your Account: Regularly check your credit card statements for any unauthorized transactions. Most banks offer online account access and mobile apps that allow you to track your spending in real-time.

Strategy 2: Harness the Power of Technology – Secure Payment Methods

Technology plays a crucial role in both facilitating and protecting online transactions. Here are some powerful tools you can leverage for enhanced security:

- Use a Secure Internet Connection: When making online purchases, ensure you are using a secure Wi-Fi network. Avoid using public Wi-Fi networks unless absolutely necessary.

- Look for Secure Websites: Verify that the website you are using is secure by checking for the "https" in the URL address and the padlock icon in the browser.

- Utilize Virtual Credit Cards: Some banks offer virtual credit card numbers that can be used for online purchases. These numbers are linked to your real credit card, but they are unique and can be revoked if compromised.

- Enable Two-Factor Authentication: Two-factor authentication adds an extra layer of security by requiring a code sent to your phone in addition to your password. This makes it much harder for fraudsters to access your account.

- Consider Mobile Wallets: Mobile wallets like Apple Pay and Google Pay store your credit card information securely on your device and use tokenization to replace your actual card number with a unique code during transactions.

Strategy 3: Secure Your Online Presence – Safeguarding Your Digital Footprint

Your online presence can be a vulnerable point for fraudsters, making it essential to protect your digital footprint. Here’s how:

- Choose Strong Passwords: Create strong, unique passwords for all your online accounts, including your credit card account. Avoid using easily guessable information like your birthdate or pet’s name.

- Use a Password Manager: A password manager can help you store and manage your passwords securely. It can generate strong passwords and automatically fill them in for you, making it easier to maintain secure practices.

- Be Careful What You Share Online: Avoid sharing personal information, including your credit card details, on social media or public websites.

- Be Mindful of Public Wi-Fi: Public Wi-Fi networks are often unsecured, making them vulnerable to hacking. Avoid accessing sensitive information like your credit card account when using public Wi-Fi.

- Use Anti-Malware Software: Install and keep updated anti-malware software on your computer and mobile devices to protect against malware that can steal your personal information.

Strategy 4: Leverage the Power of Your Bank – Utilizing Financial Institutions

Your bank is your partner in combating credit card fraud. They offer valuable tools and resources that can help you stay safe:

- Fraud Alerts: Set up fraud alerts on your credit card account to receive notifications about unusual activity. Most banks offer text message or email alerts.

- Credit Monitoring: Consider subscribing to a credit monitoring service, which can track your credit report for suspicious activity and alert you to potential fraud.

- Report Fraud Immediately: If you suspect your credit card has been compromised, contact your bank immediately to report the fraud. The sooner you report it, the better your chances of recovering your losses.

- Dispute Unauthorized Charges: If you find unauthorized charges on your credit card statement, dispute them with your bank.

- Check Your Credit Report: Review your credit report regularly for any errors or suspicious activity. You are entitled to one free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) every year.

Strategy 5: Empower Yourself with Insurance – Protecting Your Finances

Credit card fraud can have a significant financial impact. Here’s how insurance can provide you with an extra layer of protection:

- Credit Card Fraud Insurance: Some credit cards offer built-in fraud insurance, which covers you for unauthorized charges.

- Identity Theft Insurance: Consider purchasing identity theft insurance, which can help you recover from the financial and emotional damage caused by identity theft.

- Homeowners or Renters Insurance: Many homeowners and renters insurance policies include coverage for identity theft and credit card fraud.

Conclusion: Embracing a Multifaceted Approach for Ultimate Protection

Credit card fraud is a serious threat, but by implementing a multifaceted approach to protection, you can significantly reduce your risk. Be vigilant, leverage technology, secure your online presence, work with your bank, and consider insurance. By combining these strategies, you can empower yourself to achieve ultimate credit card fraud protection.

Remember: It’s important to stay informed about the latest credit card fraud trends and update your security practices accordingly. By staying vigilant and proactive, you can protect yourself and your finances from this growing threat.

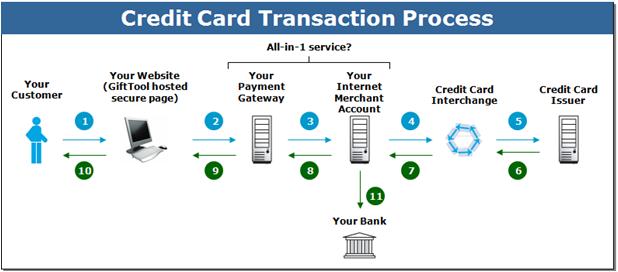

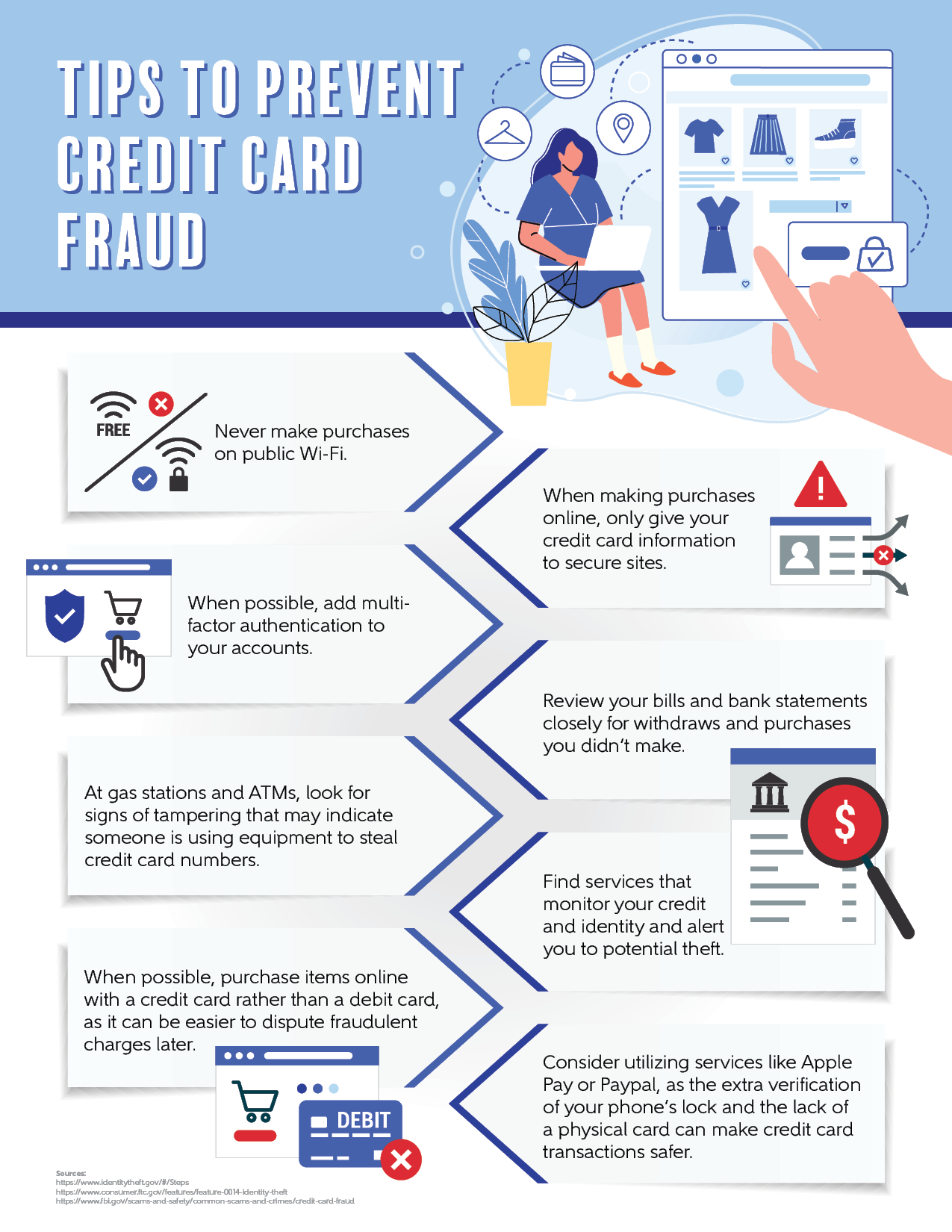

Image:

[Insert an image relevant to the topic, such as a person holding a credit card with a padlock symbol overlayed, or a graphic illustrating different credit card fraud tactics. Ensure the image is within the specified size limit of 740×414 pixels.]

Closure

Thus, we hope this article has provided valuable insights into 5 Powerful Strategies for Ultimate Credit Card Fraud Protection. We thank you for taking the time to read this article. See you in our next article!

Sponsored Website: paid4link.com