5 Steps to Transform Your Business with Powerful Legal Risk Management

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5 Steps to Transform Your Business with Powerful Legal Risk Management. Let’s weave interesting information and offer fresh perspectives to the readers.

5 Steps to Transform Your Business with Powerful Legal Risk Management

In the ever-evolving landscape of business, legal risks loom large, capable of derailing even the most meticulously crafted strategies. From compliance issues to contractual disputes, intellectual property infringements to data breaches, the potential for legal pitfalls is ever-present. However, navigating these challenges effectively is not a matter of luck or chance, but rather a deliberate and proactive approach to legal risk management. This article will delve into five essential steps that can empower businesses to transform their risk profiles, fostering a culture of proactive compliance and mitigating potential legal headaches.

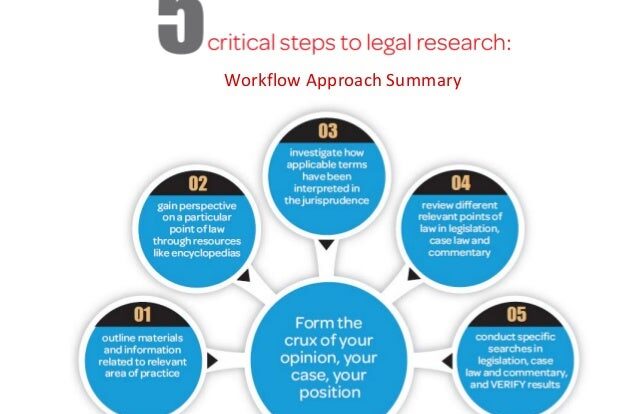

1. Identify and Analyze: Unveiling the Hidden Risks

The first step in effective legal risk management is to identify and analyze the potential risks that your business faces. This involves a comprehensive assessment of your operations, products, services, and industry, considering factors such as:

- Industry Regulations: Every industry has its own set of regulations and compliance requirements. Failing to adhere to these can result in hefty fines, legal action, and damage to your reputation.

- Contractual Obligations: Carefully review all contracts, including supplier agreements, employment contracts, and customer agreements. Identify potential loopholes, ambiguous clauses, and any areas where your business could be exposed to legal liability.

- Intellectual Property: Protect your intellectual property, including trademarks, patents, copyrights, and trade secrets. Failing to do so can lead to infringement lawsuits and loss of valuable assets.

- Data Privacy and Security: In today’s digital world, data breaches are a major concern. Implement robust data security measures and ensure compliance with relevant privacy laws like GDPR and CCPA.

- Environmental Regulations: Depending on your industry, your business may be subject to environmental regulations related to waste disposal, emissions, and other environmental impacts.

- Employment Law: Stay informed about labor laws, wage and hour regulations, and anti-discrimination laws. Non-compliance can lead to costly lawsuits and reputational damage.

Tools for Identification and Analysis:

- Risk Assessments: Conduct regular risk assessments to identify potential legal risks and prioritize them based on their likelihood and impact.

- Legal Audits: Engage legal professionals to conduct audits of your business practices, policies, and procedures to identify areas of vulnerability.

- Industry Benchmarks: Compare your practices to industry best practices and standards to identify potential gaps in your legal risk management strategy.

2. Develop a Comprehensive Strategy: A Roadmap for Success

Once you have identified and analyzed your legal risks, the next step is to develop a comprehensive risk management strategy. This strategy should outline the following:

- Risk Mitigation Strategies: For each identified risk, develop specific strategies to mitigate the risk, such as:

- Policy and Procedure Development: Implement clear policies and procedures to ensure compliance with relevant laws and regulations.

- Training and Education: Provide regular training to employees on legal compliance, data security, and other relevant topics.

- Contract Review and Negotiation: Develop a robust process for reviewing and negotiating contracts to minimize legal exposure.

- Insurance Coverage: Consider obtaining appropriate insurance coverage to protect your business from financial losses arising from legal risks.

- Risk Monitoring and Reporting: Establish a system for monitoring and reporting on the effectiveness of your risk management strategies. This can involve regular reviews of key performance indicators (KPIs) and risk assessments.

- Communication and Collaboration: Ensure clear communication and collaboration between legal counsel, management, and employees to promote a culture of legal compliance.

3. Implement and Monitor: Putting Your Strategy into Action

With a comprehensive strategy in place, the next step is to implement and monitor its effectiveness. This involves:

- Policy Implementation: Ensure that all policies and procedures are clearly communicated and implemented across the organization.

- Training and Education: Provide ongoing training and education to employees on legal compliance and risk management.

- Contract Management: Develop a systematic approach to contract management, including review, negotiation, and storage.

- Data Security Measures: Implement and maintain robust data security measures to protect sensitive information.

- Compliance Audits: Conduct regular compliance audits to ensure that your business is adhering to all relevant laws and regulations.

- Risk Reporting: Track and report on key risk indicators and the effectiveness of your risk management strategies.

4. Adapt and Evolve: Embracing Change and Innovation

The legal landscape is constantly evolving, and your risk management strategy must adapt accordingly. This involves:

- Staying Informed: Stay up-to-date on changes in laws, regulations, and industry best practices.

- Legal Counsel Engagement: Maintain a close relationship with legal counsel to obtain expert advice and guidance on emerging legal risks.

- Continuous Improvement: Continuously review and improve your risk management strategies based on lessons learned and industry trends.

- Innovation and Technology: Embrace new technologies and tools that can enhance your risk management capabilities, such as data analytics, artificial intelligence, and cloud-based platforms.

5. Foster a Culture of Compliance: Building a Strong Foundation

Effective legal risk management is not just about policies and procedures, but also about fostering a culture of compliance within your organization. This involves:

- Leadership Commitment: Demonstrate strong leadership commitment to legal compliance and risk management.

- Employee Engagement: Encourage employees to report potential risks and participate in compliance initiatives.

- Open Communication: Create a culture of open communication where employees feel comfortable raising concerns and seeking guidance on legal matters.

- Ethical Conduct: Promote ethical conduct and a commitment to doing business with integrity.

Benefits of Robust Legal Risk Management

Investing in a robust legal risk management program offers numerous benefits, including:

- Reduced Legal Exposure: Proactive risk management can significantly reduce the likelihood of legal disputes and lawsuits.

- Enhanced Reputation: A strong commitment to compliance and ethical conduct enhances your business reputation and builds trust with stakeholders.

- Improved Business Performance: By mitigating legal risks, you can avoid costly delays, disruptions, and reputational damage, leading to improved business performance.

- Increased Investor Confidence: Investors are more likely to invest in companies with strong legal risk management practices.

- Competitive Advantage: By demonstrating a commitment to legal compliance, you can gain a competitive advantage in the marketplace.

Conclusion

Legal risk management is not a one-time event but an ongoing process that requires continuous attention and adaptation. By embracing the five steps outlined in this article, businesses can transform their risk profiles, creating a foundation for sustainable growth and success. Remember, proactively managing legal risks is not just about avoiding legal trouble; it’s about maximizing your business potential and ensuring a bright future for your organization.

Closure

Thus, we hope this article has provided valuable insights into 5 Steps to Transform Your Business with Powerful Legal Risk Management. We thank you for taking the time to read this article. See you in our next article!

google.com